GM DOers!

This was a terrible weekend for many.

Silicon Valley Bank (SVB) went belly up, impacting thousands of tech start ups and 100,000s of employees. 😳

As a result, $USDC broke its peg and fell to < $0.90 for the first time, putting the DeFi and crypto ecosystem on edge. (more on this below in case you’re concerned)

And who knows what disaster might happen next…

There is a lot to unpack here, but that last thought is exactly the problem. “Who knows?”

The legacy financial system is opaque and requires trust. No one should ever have to trust something which they also can’t see. It makes no logical sense.

Yet the entire world's financial system is built in such a way. 🙄

Anyway, I’m not going to talk much about banking here, I just want to make a point about the direction our world is heading…

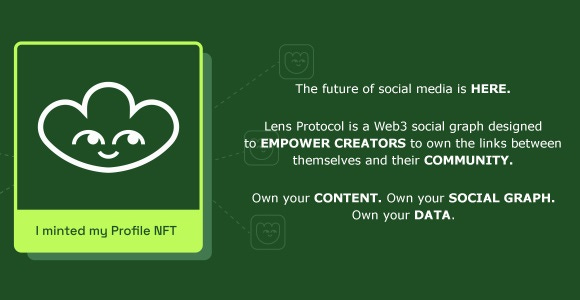

👉 Brought to You by Lens Protocol: The Future of Social Networking

The Cause of The SVB Bank Run

The cause of this weekend's events was NOT a solvency crisis like you’ve likely heard on Twitter or in other newsletters.

SVB had all the assets to pay back customers (over time). This isn’t an “FTX-like” situation where there was no money.

The problem was a liquidity crisis. Meaning, SVB couldn't convert its assets (loans, securities, etc.) into cash fast enough to suffice the amount of withdrawals from its customers.

Basically every bank in the US works like this.

So if SVB had all the assets, why was there a bank run in the first place?

The answer is instant communication + instant liquidity.

Or, in other words, Social Media + Banking Apps.

Jim Bianco gives a great detailed thread on this here:

In short, some high profile individuals like Peter Thiel began tweeting and telling founders to pull their funds from SVB out of concern for the amount of available assets SVB had (social media).

Which was the smart and reasonable thing to do, by the way, as we should warn each other when trouble is brewing.

Since millions could see these recommendations instantly, customers at SVB pulled out their phones, opened up bank accounts elsewhere and transferred money immediately (instant liquidity). ⚡

This is a phenomenon that was only recently made possible through technological innovation.

Social media and fintech applications have enabled information and liquidity to move instantly.

Now, of course, it sucks that SVB couldn’t get the cash into the hands of everyone immediately. As a result, this has turned into a complete disaster for so many people and businesses.

To be fair though, this same thing could happen to many (most?) banks across the US.

One point to consider, however, is that if you’re putting your money into a bank and expect a yield on your cash (even if it's <1%), that yield has to come from somewhere.

Which means, the bank has to do something with your cash to make that yield for you 🤷♂️

This means that we should expect that some cash the bank holds will be in other assets.

Now, I’m not going to get into the rabbit hole of fractionalized banking, because that’s not the topic of conversation here, nor is that what we talk about at Web3 Academy.

Of course, I’d much rather custody my own assets rather than rely on someone else.

And again, I’m not saying that SVB was managing their assets inappropriately, I’m just saying that if a large population stages a bank run on practically any bank, the same result will happen.

So, what I want to talk about instead is how we could better prevent these sorts of scenarios from happening.

If You Want Trust, You Need Transparency (Relationships 101)

The solution to all of these problems is transparency.

It’s literally that simple.

If banks were transparent and actually offered a good service, this wouldn't have happened.

If Peter Thiel tweeted out that SVB didn't have enough cash readily available for all customers, and we could simply verify their holdings rather than scramble to move our funds out of fear, things could have gone very differently.

We could just take a deep breath, and verify.

Those who needed cash today, might have removed their funds. But those who were holding it for 6, 12 or 24 months, would’ve have been ok with leaving it there.

After all, we all already know that banks don’t have 100% of customer funds available. That’s the risk we take to store our cash and earn some yield.

As a result of no transparency, however, customers all over the US are now afraid that their bank doesn’t have any funds to cover withdrawals, which may force even more bank runs, even if it’s not actually necessary.

If we have instant communication + instant liquidity, we also need instant transparency.

This is exactly what we are preaching in web3, too. If I’m going to build on your platform, I need to be able to see what I’m building on.

I need to understand the metrics and the risks.

Whether I’m banking with you or building on your platform, I’m entering into a trusted relationship with you, and relationships require openness and transparency to thrive.

Once there is transparency, it enables everyone to take responsibility and make informed decisions. Without transparency, I must blindly rely on people and organizations I do not know.

It's wild that we’ve built a financial system and an internet that works in this way 🤦

Thankfully, blockchains act as open and transparent trust machines for the internet. The more we move on-chain, the less we need to trust and the more we can simply verify.

That is the entire purpose of Web3 Academy PRO, to 👀🔛⛓️(look on-chain). Most people don’t quite grasp this yet, but the ability to look on-chain is going to change everything.

If you are not yet on the forefront of this, go PRO today and get started. 😉

Taking risks is all part of the game of growing your net worth. Investing in stocks, leaving your money in a bank for yield, or taking out a mortgage are all forms of financial risk.

There is nothing wrong with that.

What is wrong, however, is not having transparency to understand the risks I’m taking.

Moving on-chain and providing transparency will do wonders to prevent moments like this past weekend from occurring.

Speaking of risks, let’s talk about crypto’s ‘once upon a time’ most stable stablecoin.

Update on $USDC

For most of us web3 nerds, $USDC is a tool we use frequently.

Web3 Academy, for example, holds some $USDC in our treasury, along with $ETH and $BTC, of course. We also take payments from clients and pay our employees in $USDC.

This was a scary moment to see $USDC depeg from the dollar.

I’m sure many of you felt the fear over the weekend too. If you’re a PRO member, we shared some thoughts as it was all unfolding to keep you up-to-date on the situation inside our Discord, and make sure you didn’t sell at a loss 😉

That said, it looks like we’ve all dodged another one, my friends!

$USDC has now regained its peg and all is well!

Crypto is not for the faint of heart, is it?

This tweet sums up the last year...

Reply to this email with 🫡 if you’re still here and agree with the tweet above…

🤝 Together with SegMint: Revolutionizing the way we think of digital ownership.

Wouldn't it be cool to buy and hold parts of an expensive NFT and share its ownership and utility, like airdrops or exclusive access?

Well, say hello to SegMint.

SegMint is a non-custodial NFT platform set to launch in Q3 of this year and aims to allow users to easily create access keys and share ownership of NFTs with friends and community members.

The team is going through their Beta release soon and has opened up their waitlist for Web3 Academy listeners.

If you want to stay at the forefront of web3, sign up for SegMint's waitlist today!

Uncover More of Web3’s Latest News

Web3 publishing platform Mirror has launched a new Subscribe to Mint feature, allowing creators to “transform their collectors into an engaged web3 community”: Source

Luca Netz joins the OverPriced JPEGs podcast to talk about the power of social media and memes to grow a brand, community as a key driver of growth in the future, and more: Youtube | Spotify

🟣 Wait a second, DOers!

We’re not done yet! Check out our other learning resources, and start looking for tickets to Lisbon to meet us in person 😉

LISTEN

Curious about the biggest news from the last week? Give our last week’s Rollup episode a listen, as Kyle and JayBird go over all the crazy stuff that Snoop Dogg, Amazon, Chainlink, and others have been up to 🤯 :

Spotify | Apple | Youtube

LEARN

Take our FREE Web3 Rabbit Hole Course to get up-to-speed on the foundational components of web3 so you can confidently build, work, or use the fastest-growing technology in history.

GET A TICKET

Web3 Academy is attending the Epic Web3 Conference in Lisbon on June 9, 10. Join us at this web3 industry conference and learn how to build & grow products in the decentralized space. Go PRO to receive 25% off admission.

Thanks for reading and we’ll see you on Wednesday! ❤️

was great to see BTC hold strong during these times and the USDC repeg, but as an overall perspective, big impact on the financial system and to see how this event will impact the future with FDIC, these smaller banks and their transparency and if the "big 4" start to dominate the financial market even more with the fear that was built thru this event. SVB wasn't the only one in this position. I doubt this is the end of the story

great posting Kyle and crew! :)