Macro Update | NFT Ticketing | Ethereum Roadmap | Web3 Subscriptions | Klima DAO

Gm DOers!

Welcome back to our Weekly Rollup, the place where we help you stay caught up with the abundance of market news circulating around Web3.

Our word of the week is opportunity. Why? Because the grounds of Web3 are fertile. It is ripe for opportunity in innovation, jobs, wealth and so much more. What a time to be in the Web3 space.

Before we get into the Web3 news, we are going to start with addressing the markets. We’re seeing some green in crypto for the first time in a while and Kyle has decided to give an update on what he’s hearing and learning from some of his high profile financial clients.

Buckle up! Good times ahead 👀

Here’s today’s agenda:

Macro update

NFT ticketing

Web3 Subscriptions

Ethereum roadmap

DAO of the month

Let’s begin!

Wait 🚥 Not into reading? 📖

Sit back and watch on Youtube 👀 or listen on Spotify or Apple Podcasts 🎧

Are you a copywriter looking for employment? Apply Here and work with the biggest names in crypto 👀

Macro Environment Update

At the moment we’re free falling into a global recession 😨. The U.S GDP (aka the USA’s revenue)has been negative for two quarters straight, indicating a technical recession. Sounds bad right?

In the real world economy, yes it’s bad. But in the markets, not really (...if you’re forward thinking).

It’s essential to understand that recessions are simply economical drawbacks, corrections in the economy if you will and they are perfectly normal and actually important to occur every once in a while. But how did we get here?

The short answer: Printing money which caused high inflation. The more money you print, the more you devalue the currency. The more you devalue a currency, the more the assets priced in that currency go up. Thus, everything we purchase becomes more expensive and our savings become worth less (...Thanks Jerome Powell, head of the FED)

Now, once inflation is unbearable (like it is now at almost 10%), the regulators (the FED) have to somehow fix this. And their only tool is raising interest rates.

What do raised rates lead to?

Short answer: Recession. Essentially, raising rates makes it more expensive to access money through high bank rates, mortgages and so on… It also removes money from the economy, which leads to stagnated growth. What this does is that commodities like oil rise in price while assets like stocks and crypto crash.

This pattern of printing money and lowering rates to halting printing money and increasing rates is what’s known as the business cycle. Keep in mind that from a macro perspective, the economy is always growing, having drawbacks now and then, just like the chart shows below.

Where are we now and where are we going?

Technically, we are entering a recession which usually suggests that we’re going to go through rough waters during the next months. However, keep in mind that to recover from a recession, the FED needs to print money and lower interest rates.

Earlier this week the Fed raised interest rates but started to hint that this trend may not continue (...this is the signal markets were waiting for and why we’re seeing so much green in asset prices)

Markets are forward thinking. When retail investors hear “recession” they become scared and sell. When Macro investors hear “recession” they think “money printer and lowering of interest rates” and they begin to buy.

So, when you hear about being in a recession, begin to think about the macro perspective because now is when the most powerful opportunities appear.

To conclude this chapter, while recession means bad news for the real economy, it also means lower interest rates and money printing is coming… which means asset prices go up. And crypto being on the far end of the risk spectrum is certainly the fastest horse in the sector of growth assets. Thus it will move first when markets smell relief (which is what we are seeing right now).

So while nothing is a certainty, it seems like the scenario Kyle wrote about back in May is beginning to play out. The end of the bear may be near.

Kyle wrote a comprehensive article a few months ago regarding the macro aspects of the markets so go back and check it out.

This isn’t financial advice but we encourage you to think more from a macro perspective!

P.S. Do you enjoy hearing a bit about markets or would you prefer we never mention price and markets again and stick to utility? Respond to this email and let us know your thoughts please 🙏🏽

Web3 News & Highlights

A number of leading web3 brands have come together to establish the “Open Metaverse Alliance for Web3,” with the goal of creating a set of standards that will enable the industry to address the challenges of interoperability and build a metaverse where individual platforms are interconnected, open, and decentralized.

Unstoppable Domains (web3 digital identity startup) raises funds to be valued at 1 billion dollars. We are huge fans of Unstoppable, who we had on our podcast a while ago, so check that out.

Chipotle is offering $200k in free crypto through their "Buy the Dip, Eat The Dip" campaign. People can win by playing an online game on their site, 3x per day this week. Last month, Chipotle announced they're accepting payments in crypto through a partnership with Flexa. Now, they're getting more and more in Web3 in creative ways.

Solana has opened an apple-store-like shop. The goal? Onboard new users into the Solana ecosystem. At the store you can learn how Solana works, get your first wallet set up, buy your first NFT, make your first crypto transactions

James Howell is a dude who threw away a hard drive containing 8000 BTC, nine years ago. Now, he is determined to find it through his brand new $11 million proposal — backed by venture-capital funding — to search up to 110,000 tons of garbage. The size of the hard drive. 👇

Mercedes Benz launches blockchain-based data sharing platform in partnership with Polygon. 🔥

🧬 Community Updates 🧬

785 members! With an average of 30 new members per week.

We’ve rebuilt our onboarding sequence for new community members to make it easier to understand discord and the many way to benefit from our community.

Starting next week we’ll be offering 1-1 calls to all new community members.

We’ll also have a weekly New Members Info Session where you can learn all about the community and the many ways to get involved and meet other web3 enthusiasts!

70% of our community members want to find a job in web3. Check out our article about working in web3 and reach out to JayBird if you want a 1on1 job consult.

57 members in the DAO! Big news coming next week about the DAO. Watch out!

NFT Innovation

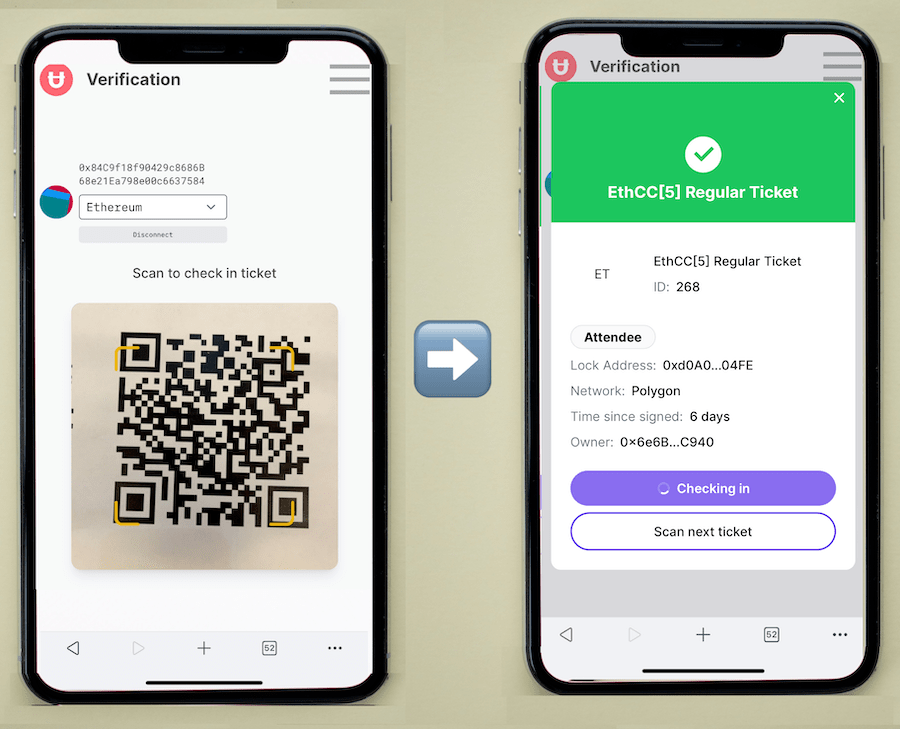

Unlock Protocol partnered with EthCC (the biggest Ethereum conference in Europe) to enable NFT ticketing. These were soulbound NFTs that weren’t sellable or transferable. Really cool implementation of NFT technology in real life. The process wasn’t perfect, but it’s a starting point for further innovation.

Btw, we used Unlock Protocol to release our proof of completion NFTs which you can claim if you take our Web3 Rabbit Hole Course!

Since we’re on the topic of NFT ticketing, let’s further explore this area by comparing them to traditional tickets. Here are the benefits. Shout out to this thread.

Prevents fraud since the blockchain is transparent and faking tickets is way harder in Web3

Lower Fees & Markup Control since platforms take like 30% or more for each ticket while NFT ticketing platform fees are minimal

Brings more revenue to creators who earn royalties on potential reselling of the tickets.

They are reusable. Since they always live in the wallets of attendees, it gives the creators the ability to further reward fans and reuse these NFTs in the future.

Web3 Launches

Mirror XYZ (basically Web3 Substack) introduces Web3 subscriptions which enables users to subscribe to any Mirror publication with their wallets and receive an email when new content is posted.

This is what Mirror writes in their blog: “For the next generation of creators and builders, a wallet-based community will be an immeasurably powerful asset. In web3, community isn’t about passive consumption, liking, or sharing—wallets transform a community into active participants via collection, ownership, patronage, and governance participation. Wallet-based communities can facilitate new creation models, new engagement models, and new business models.”

The 1s & 2s

At EthCC in Paris, Vitalik Buterin explained Etherum’s future after the merge. There are four subsequent, rhyming stages that will improve scalability, says ETH’s co-founder. Apparently the road map is only 40% done which means there is still a long way to go. Vitalik claims that Ethereum will be able to to process "100,000 transactions per second", following the completion of the 5 key phases:

Aptos, another L2 scaling solution, announces $150M Series A funding round. 🔥

DAO Of The Month

Klima DAO is a fork of Olympus DAO

Klima DAO’s goal is to accelerate the price appreciation of carbon assets. A high price for carbon forces companies and economies to adapt more quickly to the realities of climate change, and makes low-carbon technologies and carbon-removal projects more profitable.

Since launching in Oct 2021:

Facilitated the removal of over 18 million metric tons of carbon from the market

Equal to planting 87,000 hectares of forest or taking 4m cars off the road for an entire year

🚀 Action Steps For Web3 DOers 🚀

👉 Respond to this email and let us know if you’ve enjoyed hearing a bit about markets or if you’d prefer we never mention price and markets again and stick to utility?

👉 If we indeed have a bullish next months, make sure to secure your cryptocurrencies by getting yourself a Ledger!

👉 Don't forget to take our FREE Web3 Rabbit Hole Course to get up-to-speed on the foundational components of Web3 so you can confidently build, work, or use the fastest growing technology in history.