$PEPE Fever: How a Meme Coin Became a Crypto Titan

Pepe coin’s Journey, Record Growth, and Blockchain Impact

GM DOers!

Ah, nothing hits quite like a good memecoin rally. 🥴

If this is your first experience with a memecoin running up to over a $1B marketcap seemingly overnight, you might be thinking - WTF?! 😱

$PEPE coin was the token of choice in this mini memecoin bull run, with several others following the lead.

It managed to reach a whopping $1.8B marketcap in just 3 weeks AND managed to congest two of the biggest networks - Bitcoin and Ethereum.

But is this the first time we’re seeing something like this? Not really; it’s just a crypto thing. 😅

This is not the first, nor the last time that people’s degen gambler juices have started flowing and peak hype and FOMO were present everywhere you looked.

But was it different this time, what effects did this $PEPE craze have on the blockchain networks, and what can we learn from all of this? Let’s find out…

👉 Lens Protocol: The Future of Social Media

Decentralized social media finally allows creators to own their content, data and followers. That’s why we choose to build part of our media platform on Lens Protocol.

What is $PEPE and How Big Has it Gotten?

In this meme-driven crypto world, $PEPE coin is the latest sensation.

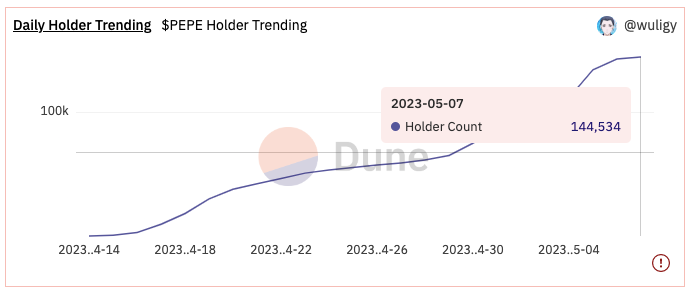

Leveraging the fame of the Pepe the Frog character, this Ethereum-based token managed to reach a $1.8 billion market cap and 107,000 holders in just 23 days since its launch. 😲

This unprecedented growth has even outpaced its legendary predecessors $DOGE and $SHIB, although it has some work to do before it can reach their marketcaps, which are currently sitting at $10B and $5B, respectively.

To achieve this, the $PEPE team adopted a potent meme-filled strategy: a capped supply of 420.69 trillion tokens (lol), with a majority sent to a Uniswap liquidity pool, and a well-coordinated meme campaign on Twitter.

Plus, listings on major exchanges like MEXC and Binance within 22 days fueled its popularity further by lowering the barrier to entry for retail masses even more.

What’s more, $PEPE's success can also be attributed to crypto participants' familiarity with the swift growth of memecoins from the 2021 $DOGE and $SHIB cycle, with $PEPE showing similar growth patterns but at a faster pace.

No doubt, $PEPE's swift rise is a testament to the crypto market's infatuation with memecoins.

However, remember that high rewards often come with high risks. ⚠️

Stay tuned as we explore how memecoins, with $PEPE at the forefront, are impacting both the Ethereum and Bitcoin networks.

(DOers - did you buy into the memecoin craze, or did you stay away from the hype cycle? Let us know in the email replies by sharing your opinion on this whole thing 🙏)

Not Just on Ethereum - Memecoins are Occupying the Bitcoin Network

Memecoins have traditionally found their home on the Ethereum network, largely due to its popularity, robust smart contract capabilities, mature and diverse ecosystem, and large liquidity.

However, the success of $PEPE has proven that this trend is no longer exclusive to Ethereum. 👀

$PEPE's rapid growth and the introduction of derivatives trading on centralized exchanges have led to increased network activity, causing notable congestion on Ethereum.

Yet, the congestion isn't confined to Ethereum alone.

Memecoins, including $PEPE, have now expanded to the Bitcoin network. By leveraging the BRC-20 standard on the Ordinals protocol, these tokens are creating significant network activity on Bitcoin as well.

To learn more about the booming Bitcoin ecosystem and Ordinals protocol, check out our recent PRO Report where we dive deep into the topic. If you’re not a PRO member yet, click the button below to go PRO 👇

Memecoins entering the Bitcoin network add diversity to the crypto ecosystem and bring a breath of fresh air to the relatively uneventful network.

However, their growing popularity has led to network congestion and spiked transaction fees. 😓

While Bitcoin miners reap rewards from this activity (which is a good thing because it makes mining more profitable and incentivizes more miners to join), not everyone in the Bitcoin community is pleased with memecoins and NFTs intruding into the ecosystem.

To learn more about the drama surrounding this, check out our Wednesday’s newsletter where we dive deeper into the Bitcoin ecosystem and separate fact from fear.

The increase in gas fees has a direct impact on the more normal transactions and DeFi activities and is pricing out smaller players as a result.

Layer-2 (L2) scaling solutions exist for both Ethereum and Bitcoin networks, but Layer-1s remain preferred for their massive liquidity.💧

For example, Arbitrum, the most popular L2, has a TVL (total value locked) of $5.8B, which is dwarfed by Ethereum L1’s TVL of $27.7B. For a viral project like $PEPE, a Layer-1 launch was logical, given the larger liquidity pool. 💰

As memecoins journey through the cryptoverse, their impact on various blockchains grows.

While $PEPE and its early investors were clear winners, Ethereum arguably benefited the most. How? Stay tuned to find out! 🚀

🤝 Together with Epic Web3 Conference: A get together of web3's brightest minds 💡

Join Web3 Academy at the Epic Web3 Conference (Lisbon + online) and hear from people working at leading web3 brands such as ConsenSys, Polygon, Binance, Ledger, Uniswap, and more.

We've got a 15% discount for you, but ticket prices go up every few days. Enter the promo code WEB3ACADEMY15 to secure your spot!

Ethereum - the Real Winner

Despite the chaos brought by memecoins like $PEPE, Ethereum emerges as the ultimate victor.

$PEPE's rapid rise and resulting network congestion has benefited Ethereum greatly through accelerated supply deflation.

Since $PEPE's launch, Ethereum's mainnet has seen increased activity, primarily due to the vast number of transactions needed for trading and speculation.

This surge in activity contributes to higher transaction fees, which, post EIP-1559 upgrade in August 2021, directly leads to more $ETH being burned.

As a result, $ETH supply deflation is happening at its fastest rate since the upgrade, underlining Ethereum's strong fundamentals and furthering its ultrasound money narrative. At the moment, Ethereum’s rate of deflation is at a whopping -2.93%!!!

So, while $PEPE and other memecoins enjoy their moment in the limelight, Ethereum continues to showcase its underlying strength as the bedrock of the DeFi and memecoin ecosystem.

Intrigued by the current web3 landscape? Join our 👀 🔛 ⛓️ (Eyes Onchain) Live Discord Session where we'll explore the most exciting charts in web3 right now. It's a great opportunity to ask questions and engage in discussions. This is a PRO-exclusive event, so if you're not a PRO member yet, click below to upgrade and join us tomorrow! 👇

Thus, although $PEPE's ascent may have been the most visible outcome of the recent memecoin cycle, it's clear that Ethereum, as the infrastructure supporting this wild ride, is reaping significant benefits.

Takeaways: The Good, the Bad, and the Ugly

First, a reminder to all our DOers: Don't Get Caught Up in the Hype Cycle! 🚀🙅♂️

😊 Good news first. Memecoins historically have been a great way to onboard new people. As these tokens go viral, more outsiders come in out of curiosity or driven by an opportunity to make a quick buck 💸. This, however, brings us to...

😓 The bad news is that many new entrants get burned by getting in too late or not taking profits at the right time. They might get scared of the space as a whole because of the negative experience they had while gambling on a memecoin.

😖 The ugly part is that as fun as they are, memecoins don't give our industry a good look, neither for regulators nor serious financial/tech industry leaders. This can obstruct adoption by big players.

Of course, what goes up tends to go down, especially when it comes to assets purely reliant on speculative demand. $PEPE's market cap has dropped significantly, but that doesn’t mean it’s going to zero. 🚫

Memes have power and are long-lasting in this space.

Just like how Dogecoin and Shiba Inu token survived past bear markets, so can $PEPE. 🐸

Regardless of how this plays out, we warn you to be careful with these gambles. 😰

We at Web3 Academy work tirelessly to educate you on the fundamentals so that you are better prepared to capitalize on web3 opportunities.

That’s it for today, DOers. I hope you’ve enjoyed this journey into the $PEPE saga. If so, make sure to let us know by liking this post. 💜

Still, you might be wondering - how does all this tie into your journey as an investor or a builder in web3? 🧐

Read on to find out…👇