State of Crypto Markets: How To Survive The Bear Market | Lark Davis

Gm Web3 Academy DOers!

It is widely known that we’re all about Web3 utility. We explore how to use Web3 tools to create thriving communities and build sustainable business models.

We usually prefer to avoid prices because it’s irrelevant to our mission.

However, it’s no news that the markets have been in a downtrend ever since November 2021 and that can scare a lot of market participants away.

It is our duty to reassure the existing members in Web3 that this space is here to stay. Therefore, we felt relevant to talk about the state of the markets and give an explanation about what’s going on.

To accomplish this, we decided to bring on none other than crypto investor & educator, Lark Davis. Lark has over 1 million followers on twitter, 500,000 subscribers on Youtube and over 40,000 subscribers to his Wealth Mastery Investor Report. 🤯

We discuss the reason behind crypto’s negative trajectory, on-chain metrics, market sentiment, technical analysis, fundamentals and much much more. We hope that this helps everyone remain grounded and find a positive long-term mindset on this space. Those who can make it through these tough times will have the best opportunities ahead of them!

Let’s get into it.

P.S: We'll host a community call on our Discord next Monday on the state of the crypto market! If you'd like to share your thoughts, come along!

You can also watch the episode below, or listen on your favorite platform: Spotify | Apple Podcast | YouTube

Macro Stats

To provide a little bit of context, it is relevant to discuss the macro environment, because we believe that it is what is causing the crypto markets (and all other markets) to crash.

So, what is it that we’re seeing happening in the world?

Inflation is out of control. The FED hasn’t seemed to be able to control it because we have yet to reach a peak.

Mortgages are at an all time low. People are taking less and less loans to buy property, something we haven’t seen in like 30 years.

Not only do people not buy property, they’ve given up on buying stocks too. The equities market is in a brutal bear market. We are seeing some tech stocks being beaten harder than crypto. But we’re the most volatile market, sure…

Bond yields have inverted, something that typically triggers a recession.

In a nutshell, the macro statistics haven’t been this bad since the great depression of 1930. However, we’re not saying that we’re entering the same brutal reset period, because the markets are different today from all perspectives.

Keep in mind that all of this is happening because the FED wants it to happen. Actually, they’re the ones causing it. The main tool for the Federal Reserve System to cause a reset in the economy is to actually crash the economy, discourage investing and incentivizing people to save money in the bank.

However, the hard part for investors is that there’s nowhere to go.

Stocks are being crushed

In crypto, you’re likely to lose 50%+ of your investments due to heavy volatility,

Metals are way too stable to give you a significant return (Gold is trading at 1800$ today, as it did in August 2011…)

The housing market is way too expensive to get into and you’d basically overpay for any property

Going into cash means dealing with a 9% inflation

So, the only escape for regular people is to learn a new skill, increase their income, spend less and dollar cost average into valuable assets that are currently trading at discounts.

Current State of Crypto

Let’s keep in mind that we are self-regulated in the crypto markets and there’s no central bank to bail us out, unlike what happened in 2008 in the traditional finance world.

In crypto, everyone (whether you have $100 or $1B) has to deal with emotionless smart contracts that execute and liquidate you without mercy and negotiation.

And that’s what we’re seeing happening right now with Luna, 3AC and Celsius. It looks like unless SBF comes to the rescue, you’re getting liquidated.

But, let’s try to look beyond the FUD and into the fundamentals of crypto and Web3, which have never been better. We are currently trading (Bitcoin) at the same levels of 2018, which makes ZERO sense because back then we had:

NO DeFi

NO NFTs

ZERO Institutional / state adoption

Basically 1 functional blockchain (Ethereum) which was horrible in terms of UX

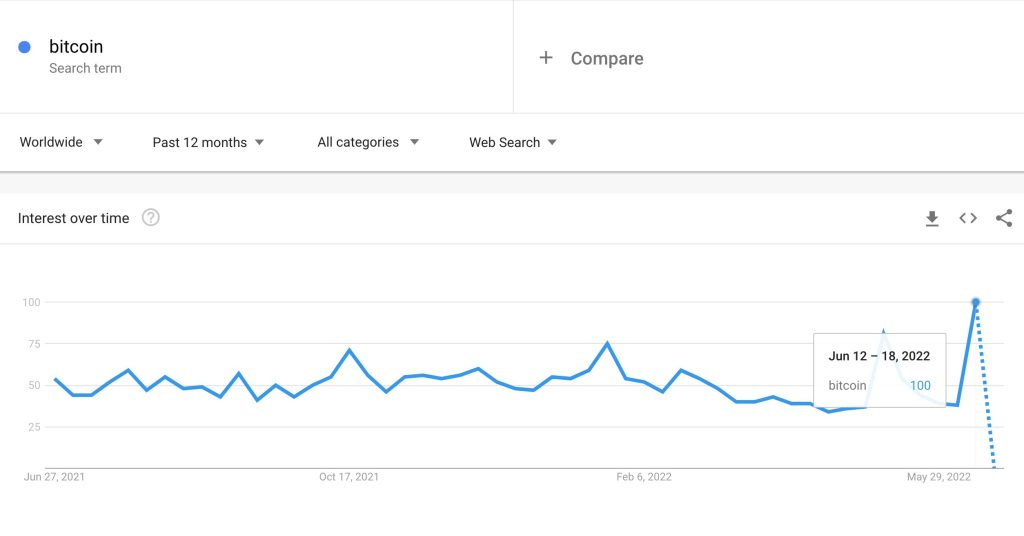

Right now, we have a dozen Layer 1 and Layer 2 chains that support DeFi and NFT trading, a dozen of different NFT marketplaces with quality UX, banks providing crypto services to clients, nation states having BTC as legal tender, around 100.000.000 new people that have joined the markets and the highest interest in Bitcoin in the last 18 months.

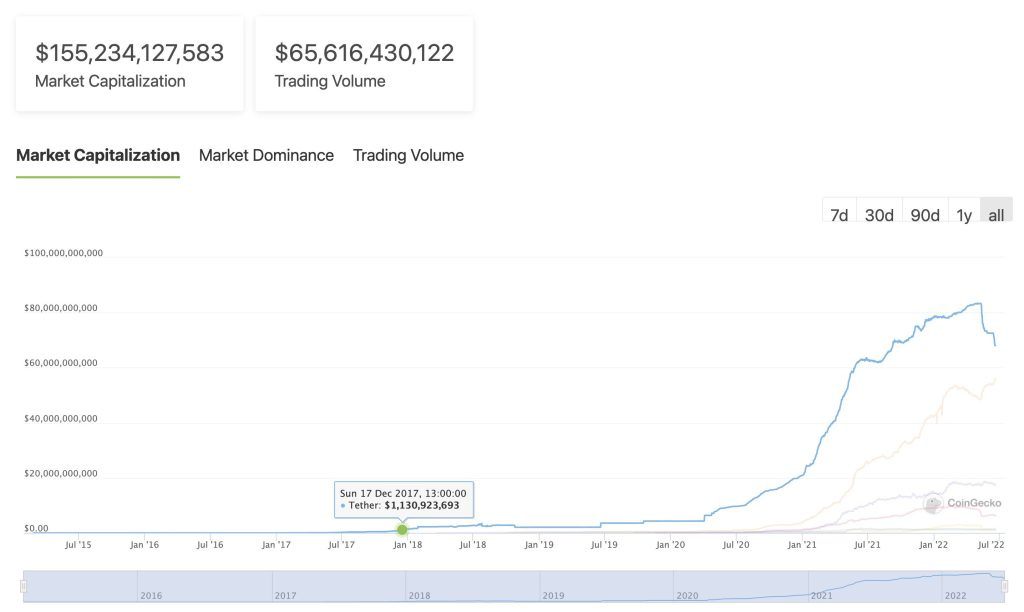

In addition to all of that, we now also have 150x more stablecoins on the market compared to 2018!

This space has never looked better before in terms of fundamentals.

So, let’s now take a deeper look at the state of the markets through analyzing Bitcoin, which in the past has been the main decider of where the markets usually go.

Bitcoin Back To Previous All Time High (ATH)

Never before, in the history of Bitcoin has it come back to trade under the previous ATH of the prior bull market. In 2018, Bitcoin reached a top of $20k (for a brief moment). During the last week, Bitcoin traded at $17.5k for a brief period of time.

We are back above this previous ATH high now, but we’re in uncharted territory in terms of trading patterns of crypto.Although history rhymes (as you’re going to see moving forward), it’s definitely not the same! Could this be the end of the 4 year Bitcoin halving cycles?

Bitcoin 200 Week Moving Average (MA)

Bitcoin has come down to trade under the 200 Week Moving Average. During past bear markets, this was the line that indicated a market bottom. Right now, we are trading slightly under the 200 week MA line.

Keep in mind that Bitcoin traded 15% under the line in 2015 and 30% in 2020. Just because we hit the 200 week MA, doesn’t mean we’re at a bottom. However, we can say that usually trading at these levels has indicated major financial opportunities.

While we’d love to be certain, due to the very worrying macro environment, there’s no guarantee that we won’t go lower.

The best strategy right now is to not rush and dollar cost average into valuable assets!

Bitcoin Trading Volume

Last week, we experienced the third biggest volume week ever. Only in May 2021 and March 2020 have we had more significant trading volume weekly periods.

Keep in mind that these high volumes (although negative) are so big due to the fact that there’s a lot of buying pressure too.

For every panic seller, there’s a panic buyer!

Again, this also shows an instance of capituation which would normally indicate that the bottom has been formed or is very close to forming.

Fear And Greed

One thing that Lark mentioned to us that hasn’t changed at all since 2017/2018 is the investor sentiment.

Usually, investors get overly bullish at market tops and overly bearish at market bottoms.

Back when we were at $69k for Bitcoin, everyone screamed for $500k while now, everybody predicts a $3k Bitcoin.

The fear is generally present in the market, something that has a negative impact on the price action. As we can see below, this time around, Bitcoin investors have marked the biggest realized losses in the history of Bitcoin.

Stablecoins

The stablecoin market capitalization is right now at $150B, which translates to representing 15% to 20% of the entire cryptocurrency market. Whenever investors feel that it’s time to open positions, things will move very fast because $150B can now have a tremendous impact on a total crypto market now under $1T.

The Illiquid Market

On-chain data shows that 65% of all Bitcoin is in the hands of HODLERS that have not moved or sold any Bitcoin in the last 12 months. This Bitcoin represents around 25% of the entire market. If we assume that Ethereum holders also don’t intend to sell, we can conclude that 30% of the cryptocurrency market is not for sale.

Take that into account along with the 20% stables and you have 50% (half) of the cryptocurrency market that is either not selling or ready to buy.

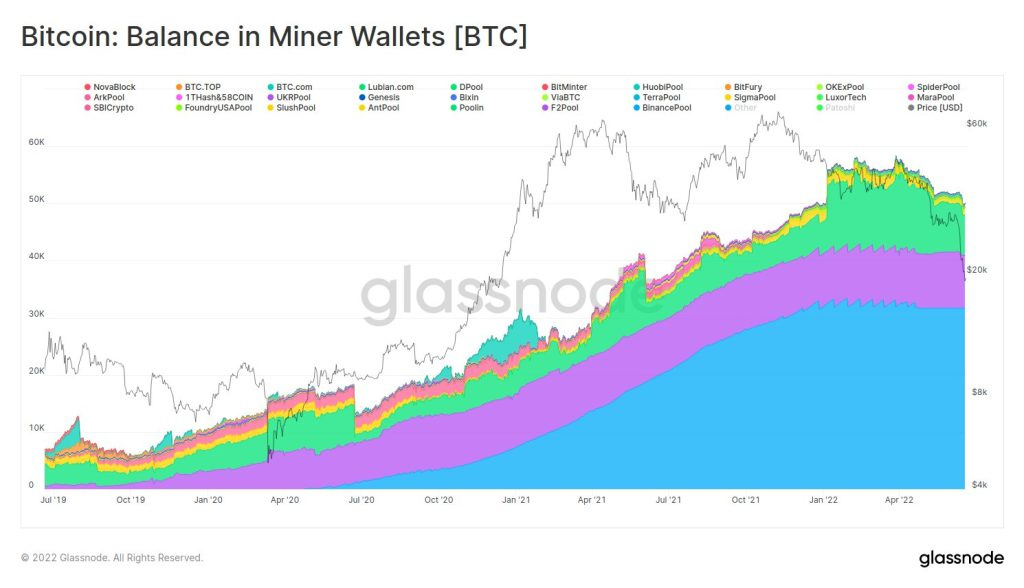

Bitcoin Miners

While everything sounds good, let’s not forget about the miners who already started to sell (9k BTC so far). They have an additional 50k BTC in total that they hold for the time being. However, this is a wildcard because if miners feel the need to cover extra costs, pay investors or buy new equipment, they will use this BTC to do so. A 50k BTC dump would definitely hurt the market further right now. Let’s hope it doesn’t happen.

Conclusion

As we’ve already established throughout this newsletter, it is clear that crypto and web3 is working. DeFi protocols are stable, The NFT space is innovating and growing and no major decentralized protocols have failed.

What we’ve seen fail however are the centralized protocols that have acted irrationally and irresponsibly, but that’s not a crypto problem, it’s actually a problem crypto and web3 fix!

With that being said, the overall market conditions from a macro perspective are still very fragile and uncertain. We’re still recovering from the pandemic, we have an ongoing war and our leaders seem to have lost control of the situation.

The on-chain analysis that we’ve conducted today alongside Lark is mostly showing that we are nearing a bottom for the cryptocurrency markets.

Keep in mind that all of these are simple indicators that will easily get invalidated in the case of a black swan event like sustained high inflation or even a housing market collapse.

Our final advice is to Stay Involved! The main thing about the bear market is to survive it. This is the time to learn about crypto and the technology in preparation for the next bull market which will undoubtedly occur. Staying involved right now will turn out to be life changing.

Whether you want to invest in this space or build a business, there is no better time to do so than during a bear market. If you can allocate capital, build a business or get a job in this space now, you will undoubtedly be set up for success in the coming years.

While the prices being this low can be scary, it’s time to change your mindset and understand this is a gift. It is one of the best opportunities to enter one of the fastest growing technologies in history! Good luck out there frens :)

Wealth Mastery Investor Report

Wealth Mastery is Larks Investor Report. He has a team of 8 analysts and researchers which help you understand where the opportunities are across the broader crypto and web3 space.

Whether you want to learn about macro and technical analysis, the newest tokens launch, deep dives into various altcoins or even the best NFTs to flip, Wealth Mastery has you covered.

You can join for free here, however if you want to get the most out of the investor report and find the real alpha then you might want to pull out a credit card and go premium!

Speaking of Alpha, Lark and the team are launching a new feature next week called the Crypto Alpha Report. A monthly breakdown of all the most immediate opportunities so that you can profit even during the bear market!

Connect with Lark and learn more about him

On Twitter

Get a Job in Web3

Have you ever considered working in Web3? Let us highlight the benefits for you:

Better pay

Remote work

Contribute to the fastest growing industry

We've made it our mission to onboard not only users but also talent into Web3! Our Web3 Academy Collective aims to connect the most impressive talent with the most exciting opportunities.

So, if you're looking for a job...

Or, if your Web3 company is looking to hire...