GM DOers!

Apple sells iPhones. 📱

Starbucks sells coffee. ☕️

Blockchains sell blockspace.

For all the complexities that come with blockchain technology, it’s really as simple as that.

Blockchains produce a product called blockspace and they sell it via a term called gas.

I’d love to take credit for the saying above, but I have to give that to our friends over at Bankless, Ryan and David.

They’ve ingrained this into my head over the years and it makes understanding the sustainability of this space so much easier.

If you want to understand which web3 real estate to build on, store your assets on or to invest in, understanding this concept is critical.

Blockchains are a business that sells a product.

Like any business, if they are not profitable, then over time the business will fail.

Luckily for us, a blockchain’s revenues and expenses are all on-chain. So we can take a look at how business is doing anytime we want 👀🔛⛓️

Today, we will do just that.

I’m going to show you how to understand the profitability of any blockchain in the space, from Layer 1s to Layer 2s.

Blockspace, The Killer Product of the 2020s

Blockspace has found product-market fit in recent years.

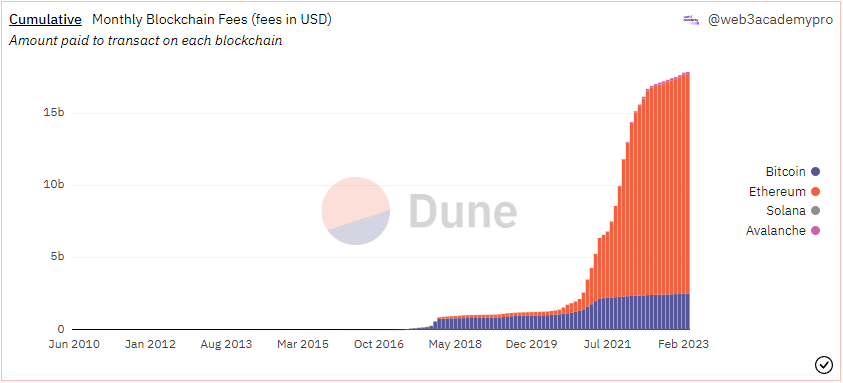

On Ethereum alone, we’ve spent over $15,000,000,000 to use its blockspace.

But why has it reached product-market fit?