The Great NFT Marketplace War. Who's Winning And Why?

A story of innovation, rugs and tokens!

The battle for market share.

Competition among businesses can be an exciting thing to watch.

IBM vs. Apple in the 90s for desktop computers.

Microsoft vs. AOL in the late 90s for the dominant internet browser.

Samsung vs. Google vs. Apple in the last decade as the top mobile phone.

In the crypto world, we’ve witnessed an epic battle for market share among many layer 1 blockchains since Ethereum's launch in 2016.

And in 2020-21, we watched a battle between Uniswap and Sushiswap (among others) to see who would win out as the dominant DEX (decentralized exchange) in crypto.

Since 2022 however, there has been no hotter battle in web3 than the one between NFT marketplaces. Competition is fierce.

It includes everything from technological innovation, feature rugs and of course, plenty of tokens. It’s been a fun story to keep up with.

But, do you know what’s really cool about the market share wars in Web3? 🤔

We can watch it unfold in real-time, on-chain!

We don’t need to wait for a company's quarterly earnings report or trust their PR team, we can stay up-to-date on the minute by 👀🔛⛓️

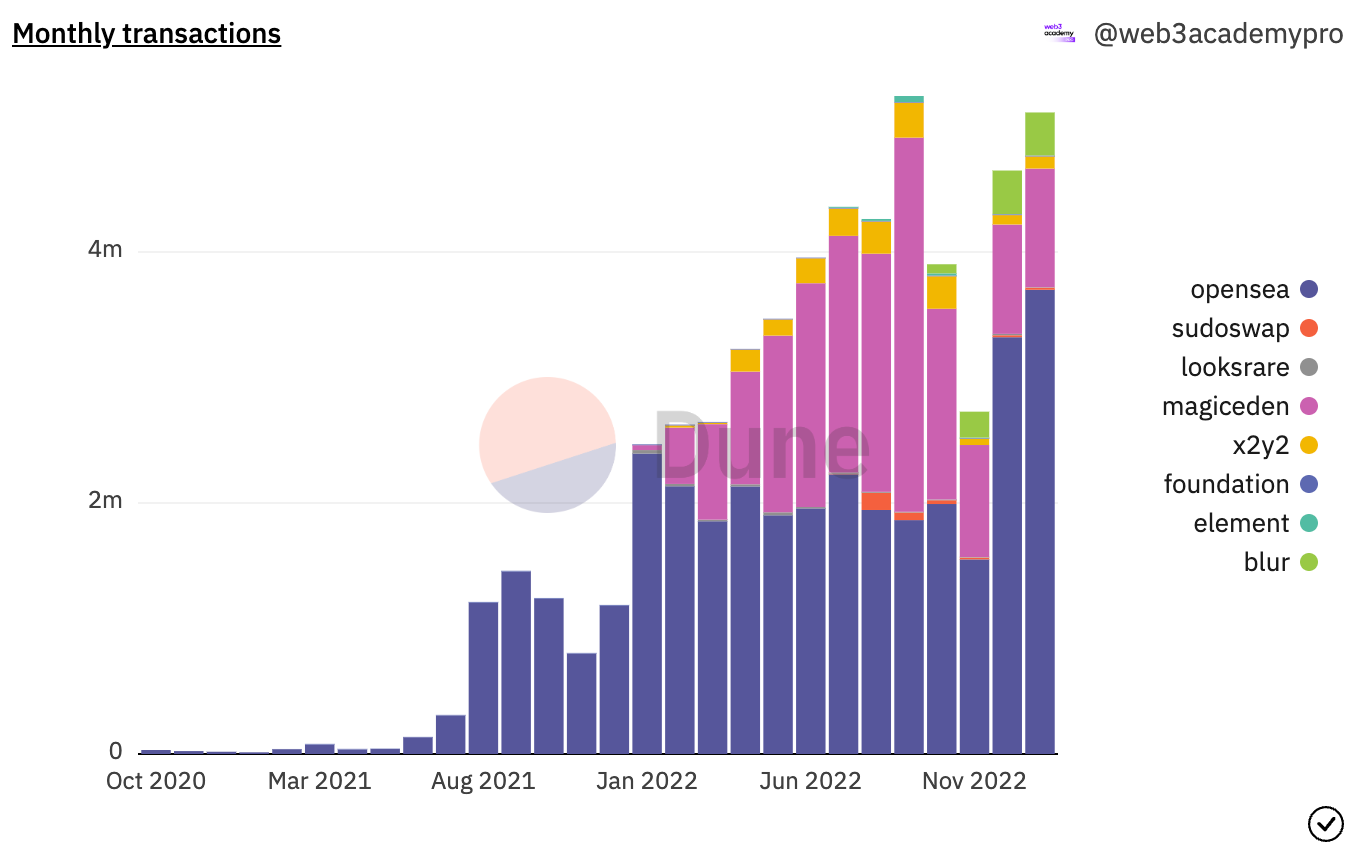

The chart below tells an incredible 3 year story about the adoption of NFTs and the marketplaces that enable this budding economy to exist.

If the chart above makes little sense to you, don’t worry…

In this report, I’m going to use the chart above and many more to walk you through the heated competition between NFT marketplaces over the last few years.

I’ll share some launch and growth tactics that some of the marketplaces have used to gain market share as well as some of the shady moves that have been pulled to gain an edge on competitors.

Buckle up friends, we’re going for a ride down memory lane! 🚀

By the way, this NFT marketplace war is far from over. If anything, we’re right in the heart of it now as you read this report. So this will get you up to speed on where we are and how we got here.

Plus we’ll speculate a little on where this will all go.

Let’s get into it 👇

Part 1: The Battle Begins

OpenSea launched in 2017 and stood alone in the market all the way until Foundation launched in February of 2021. At the time, monthly volumes for NFT sales were reaching $100 Million USD for the first time.

However, it didn’t last long as OpenSea quickly squashed the market share gains that the niche marketplace Foundation was making by the end of Q2 2021.

For the rest of 2021, OpenSea dominated the market with 98% market share in transactions, users and volume traded. During the same time, each of these metrics grew significantly, as you can see in the chart below.

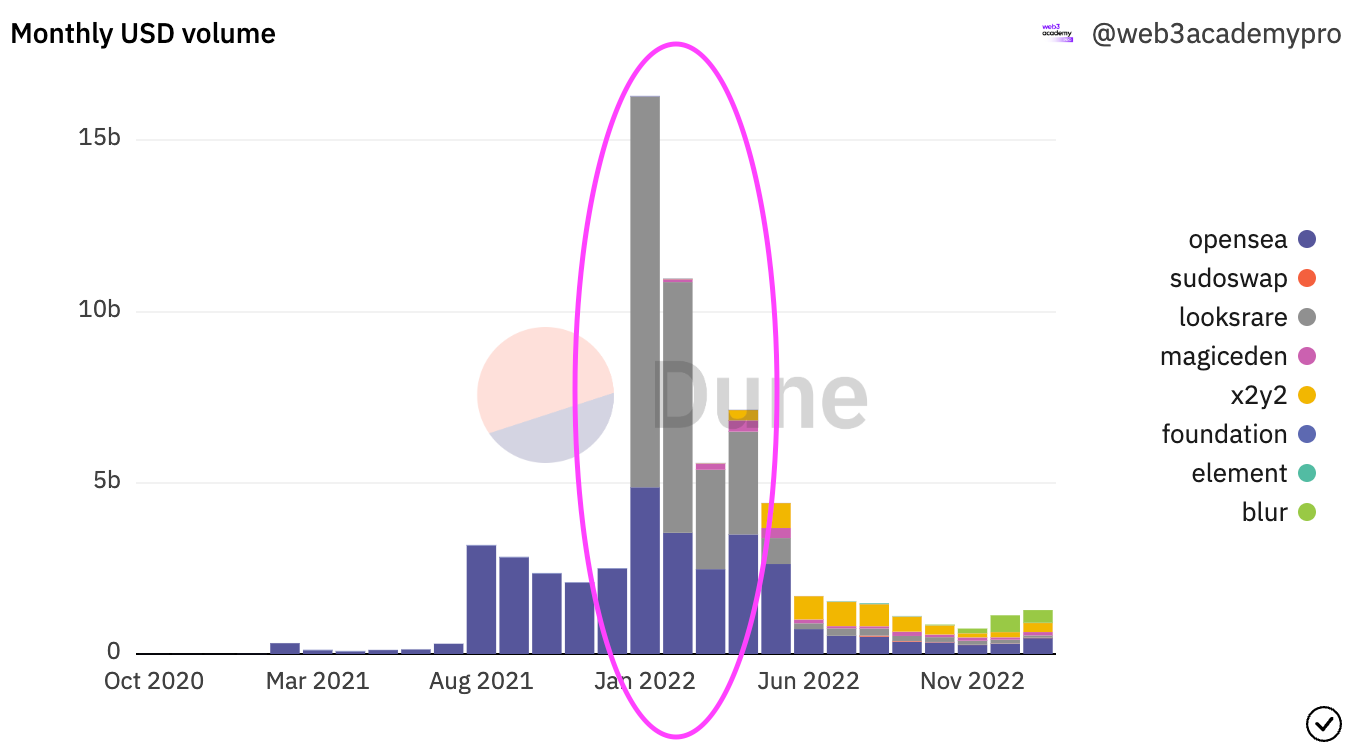

What’s interesting about the NFT marketplace wars and a big reason as to why OpenSea remains the dominant player today is that basically every other marketplace launched at the top of the NFT bull market in early 2022.

These marketplaces have been fighting for a shrinking pie of NFT sales and volumes since the beginning of the war.

The good news today however is that while volumes are way down, it seems that they have bottomed out, and as we can see below, transactions are actually pushing up against reaching new all time highs.

LooksRare, The First Real Competitor?

The last time the NFT industry was pushing through all time highs was January 2022, when LooksRare entered the market with a bang.

LooksRare didn’t just launch a decentralized version of an NFT marketplace to compete with OpenSea, they also shocked the industry by airdropping millions of dollars worth of $LOOKS tokens amongst those who bought or sold at least 3 ETH worth of NFTs on OpenSea.

The catch however, was that in order to claim the tokens, users needed to transact at least once on the new LooksRare marketplace.

In addition, LooksRare incentivized users to continue to use the platform by creating a rewards program, effectively giving away $LOOKS tokens on an ongoing basis to those who used the platform.

So, how did it work, you may ask?

Within 2 weeks of launching LooksRare controlled 82.5% of the entire NFT sales volume! 🤯

This was the first time OpenSea felt any real hint of potential competition.

If you look a bit closer on-chain however, something didn’t appear right about these numbers.

How did the total NFT market go from $2.5Billion in volume up to $16Billion in 1 month?