The State of Regulation In Crypto and Web3 in 2022 | Lisa Rubin & Adam Garetson

Gm Web3 Academy DOers!

Should crypto and Web3 be regulated?

How does a government even begin to regulate something so new and complex, not to mention something that isn’t owned by a person or company?

Regulation in crypto and web3 is hella confusing, yet we hear about it more and more frequently.

The truth is, regulation is going to happen one way or another. So we believe it’s a topic that we should all understand and figure out how to support.

Therefore, we decided to sit down with a couple of lawyers that are working in web3 (in the US and Canada) to talk about where regulation is at and what its intentions are in the long term.

Lisa Rubin (US) is a Blockchain & Fintech Attorney at Paul Hastings while Adam Garetson (Canada) is General Counsel and Chief Legal Officer of TSX-listed WonderFi Technologies.

These two are perhaps the most relevant people to talk to in regards with regulation. So, in this article, we will cover:

What’s the current regulatory landscape in the US and Canada

Do regulators even grasp the crypto & web3 sector

How web3 sectors like DAOs, NFTs and Stablecoins can be regulated

Let’s dig into this!

Wait 🚥 Not into reading? 📖

Sit back and watch on Youtube 👀 or listen on Spotify or Apple Podcasts 🎧

Have you taken the Web3 Rabbit Hole course and claimed your proof of completion NFT?

If not, what the hell are you waiting for?

What Is The Current Regulatory Landscape in Canada and the US?

First, let’s establish one thing: regulation is a good thing.

Having a regulatory framework is more reassuring both for investors and for Web2 companies that would like to dip their toes into Web3.

If you think about it logically, what’s more important?

Experimenting & working in an unregulated environment

Or…Having the certainty that nothing bad will happen to you from a legal perspective?

And for most businesses and business owners, the latter is certainly more important.

Now… What's the status in the West, when it comes to regulation in crypto and web3?

Both Lisa and Adam have expressed that progress has been made in both countries, especially during the last couple of years when crypto and web3 have gained some traction and popularity.

The key takeaway from our discussion was in fact that Canada is far more friendly in regards to web3 and crypto in comparison to the US. This doesn’t come as a surprise since Canada has already had a Spot BTC ETF for quite some time now while the US regulators are still figuring it out.

Nevertheless, the bottom line is that neither of the two want to be left behind in the future.

And understandably so… Web3 brings a lot of benefits to countries, benefits which are even more remarkable now that the FIAT currencies are melting away.

Some of the benefits include financial inclusion, transparency, the creation of more jobs and even crypto mining…

Thankfully, the Western countries seem to understand these benefits.

P.S: We've written a thorough article in the past on how to deal with PR and Crisis manangement in Web3. Read it to learn how we can further legitimize Web3 and Crypto!

Do Regulators Even Understand Crypto and Web3?

After our discussion, it was clear that the Canadian authorities were significantly more up to date with this topic than the US.

However, there’s decent progress happening in both countries.

More and more politicians are starting to propose bills, encourage innovation and even use it to their advantage.

Although progress is made in congress, we inevitably arrive at the same worrying question: If they really grasp Web3, what will they do about the power that’s being taken away from them?

Because that’s a topic worthy of discussion. Perhaps they understand that people like speculation… But do they really understand that Web3 shifts the power from governments and centralized companies into the hands of the people and the users?

And if they do… Will they let it happen? Or how will they even stop it?

Currently the answer is uncertain. Regulators definitely understand the monetary part of crypto, we are unsure yet however if they understand Web3s full potential. It seems that the level of knowledge varies significantly across members in congress.

Do you think that regulators understand Web3? Reply to this email right now with Yes or NO!

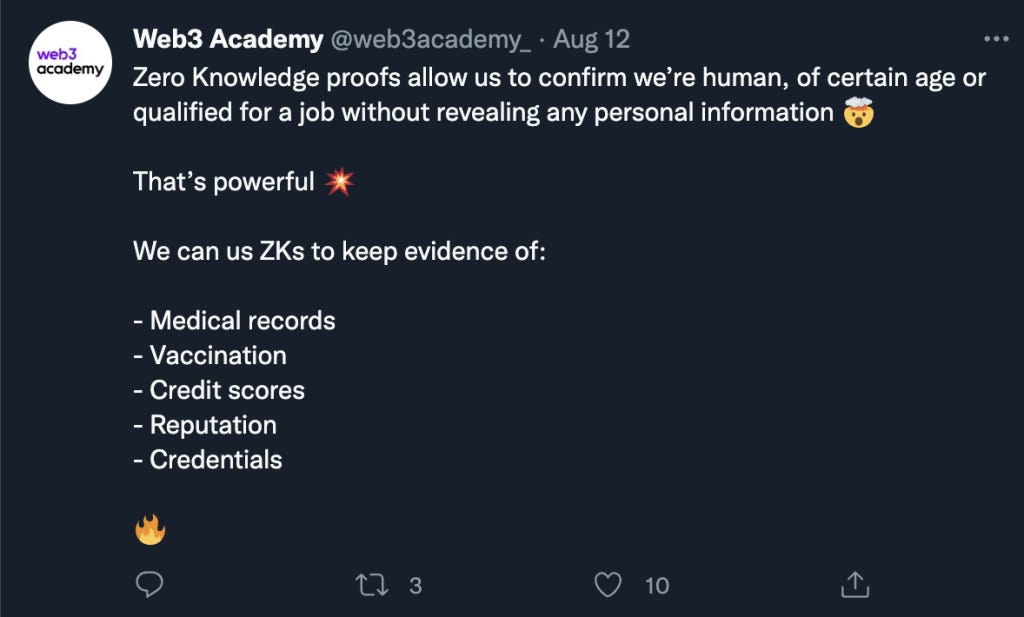

🎉 Tweet Of The Week 🎉

P.S: If you want to learn more about Zk rollups, check our convo from last week with David and Sylvia from Polygon Hermez and Polygon ID!

Which Web3 Sector Will Be Targeted By Regulators?

Something that people don’t quite grasp is that Web3 is huge. And when we talk about regulation, we have to be specific. Are we talking about DAOs, NFTs, tokens, DeFi, Oracles, Stablecoins or what?

Regulation will not occur all at once. There will be gradual laws implemented for each sector.

So, which sector will be the first to experience regulation?

How and When Will Stablecoins Be Regulated?

Both Adam and Lisa believe that stablecoin regulation will take place first in web3. In fact, clarity will likely be shown as soon as this year.

The explanation behind this is that stablecoins are the easiest to regulate thanks to their 1:1 peg to the dollar (excluding UST, lol).

Basically, regulators have to solely keep an eye on the treasury behind the stablecoin so that it's backed 1:1 with the dollar.

However, it’s not quite as easy as it sounds, because companies like Tether (USDT) and Circle (USDC) are practically issuing currencies. But don’t you have to be a bank to do that?

Questions like these are always popping up and the likely outcome will be that those who aren’t banks will have to go through tougher regulation.

The bottom line however, is that regulators cannot stifle innovation because it’s in their interest for this to happen, especially in the United States.

If you have the US dollar backing a US stablecoin, you are essentially putting it on crypto rails and enabling peer to peer transactions all over the world via the US dollar. This would put the dollar in a very favorable position for the future in terms of keeping its lead as the world currency.

It seems favorable that US regulation on stablecoins will be here very soon, and it will be bullish for the overall cryoto and Web3 space!

How Will NFTs Be Regulated?

Some NFTs may meet the criteria of being considered a security. Kind of like stocks, Some form of NFTs are a means through which holders own a piece of the project and through which the project raises funds to accomplish their roadmap. Sounds like stocks, right?

If NFTs were regulated as securities, that would impose huge problems because it would demand the core team to comply with certain rules such as having shareholder meetings, monthly and yearly statements, public teams and KYC:d holders. All of which go against the ideals of Web3 which is supposed to be permissionless,anonymous and move at the speed of the internet.

Nevertheless, the existing laws will definitely not be suitable for NFTs and they will have to be adjusted. Otherwise, there will forever be non-compliant projects flying under the radar and regulators will waste time playing tag.

How Will DAOs Be Regulated?

DAOs are basically decentralized LLCs which have a bunch of owners for the same company. Usually, when starting a business, the owners (could be multiple) have to file documents with the authorities and register their name to the company.

But how do you achieve that in a DAO which has thousands of owners, throughout the entire globe? It’s impossible.

There is some regulation in this space, specifically being led in Wyoming which allows DAOs to form an LLC and become regulated in similar ways to a typical company in the US. It seems this is more of an “in-between” solution for the time being, before new regulation forms which better suit and enable a DAO.

This is one area which may take some time and effort to reach favorable regulation.

😂 Meme Of The Week 😂

DeFi (Decentralized Finance) vs CeFi (Centralized Finance)

Regulation in web3 is super weird because of the mix of DeFi and CeFi.

During the past few months, we’ve witnessed the collapse of big crypto players like LUNA, Celsius or 3AC. What did they all have in common? CENTRALIZATION.

These were centralized companies operating in the crypto space. DeFi on the other hand (the decentralized web3 protocols) have done very well despite the enormous crash in the crypto markets.

So, who shall be regulated? There is a clear discrepancy between pure decentralized protocols and centralized companies that do web3 stuff.

Most likely, regulation will first come for those who can be found physically, aka the centralized companies that are run by a team.

The truth is, you cannot come after a decentralized piece of code. (Actually, the Tornado Cash incident is contradicting this but we still have to wait to see how this plays out.)

The only certainty we have right now is that this is going to get interesting and we will definitely watch closely to see how regulators act.

Conclusion

This article has perhaps raised more questions than settled confusions. For that, I am sorry!

The bottom line is that regulation is still super early and we’re not even close to having a clear framework for Web3.

Laws will need to be adjusted and even created from scratch in some instances. One thing that is for sure is that regulation will be a good thing for this space. It will allow for enormous amounts of capital and the largest companies in the world to enter the space without worry.

Similar to regulation of the internet however, it likely will be a bumpy road along the way. There will be good and bad regulation and likely many lengthy court cases to fight.

What we can do for now is pay our taxes and pray that regulators won’t try to be hostile against Web3!

Thanks for reading!

Connect with Lisa and Adam on LinkedIn

🚀 Action Steps For Web3 DOers 🚀

👉 By replying to this email with YES or NO, tell us if you think regulators understand crypto and web3!

👉 Take our FREE Web3 Rabbit Hole Course to get up-to-speed on the foundational components of Web3 so you can confidently build, work, or use the fastest growing technology in history

👉 If you want to learn more about how we can further legitimize web3, read our article on PR and Crisis management in Web3, to learn how you can deal with unforeseen events