Top 3 Reasons Why The Ethereum Merge is Important For Web3

Dear Web3 Academy DOers!

The Ethereum merge is happening.

No seriously, this time it’s actually happening!

September 15-16, 2022 is now the consensus date amongst the Ethereum core developers working on the ETH Merge.

It seems that ETH 2.0 is finally here (barring no heavy technical issues in the coming weeks of course).

The Ethereum merge from Proof of Work (POW) to Proof of Stake (POS) is a technological feat of large proportion. It will have significant impacts across the Crypto and Web3 ecosystem at large.

In this article, I’m going to explain what the Ethereum merge is and break down the 3 reasons why it will have such a massive impact on Web3.

Here’s the tl;dr: 🥱

🌿 Web3 goes green and becomes available to businesses around the world

📈 Improved security and “number-go-up” technology

👶 The internet bond is born

All of this happens with the flip of a switch in about 1 month from the time of this writing. It’s time to buckle up and get ready for the next phase of Web3 🚀

Wait 🚥 Not into reading? 📖

Sit back and watch on Youtube 👀 or listen on Spotify or Apple Podcasts 🎧

Do you think the merge will happen on time? Reply to this email with YES or NO!

What Is The Ethereum Merge? (aka ETH 2.0)

The Ethereum Merge is simply a transition of how the blockchain validates transactions, moving from Proof of Work to Proof of Stake. The details on how all of this works isn’t really necessary to understand the implications this has on Web3, but I will give a quick summary anyway.

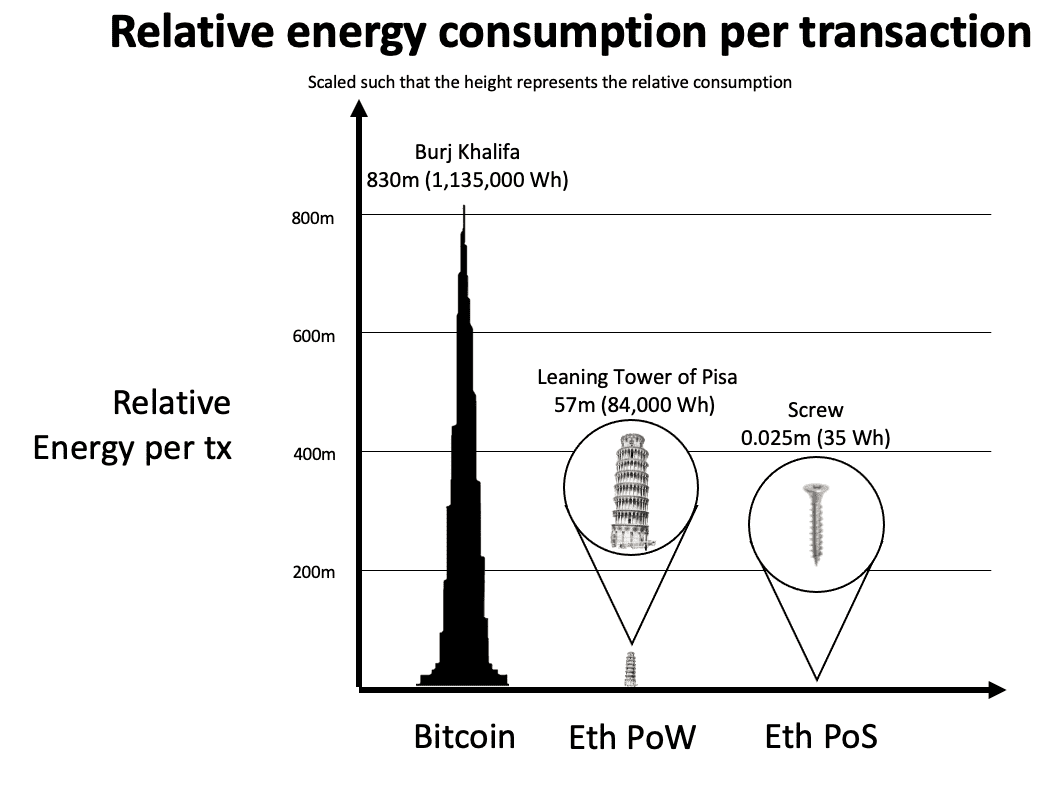

Proof of Work consensus is where large mining equipment around the world is used to solve mathematical equations and compete to verify transactions. While this can be a great form of consensus to ensure decentralization it requires a lot of electricity, equipment and resources.

Proof of Stake consensus is where participants stake a certain amount of crypto and are selected randomly to validate the transactions. This mechanism requires little energy and can be performed on a regular laptop or potentially a phone.

The move from POW to POS has vast implications in terms of:

Lowering the expenses the blockchain incurs to pay for security (you can learn more about blockchain revenues and expenses here)

Decreasing the energy and resources required for someone to participate in validating transactions

Improving the security and prevention of bad actors attacking the blockchain.

It’s important to note that the Ethereum Merge will have little to no impact on gas fees. That is NOT the purpose of the Ethereum Merge, though there are alternative projects underway in the Ethereum roadmap which will lower gas fees in the future.

Let’s first discuss the implications of the Merge in regards to the environment

The Ethereum Merge Lowers Cryptos Carbon Footprint

If you haven’t heard, crypto has a bad rep when it comes to energy usage and carbon footprint.

Bitcoin is front and center of this criticism as the leader of POW blockchains, however Ethereum in its current state also finds itself in the spotlight.

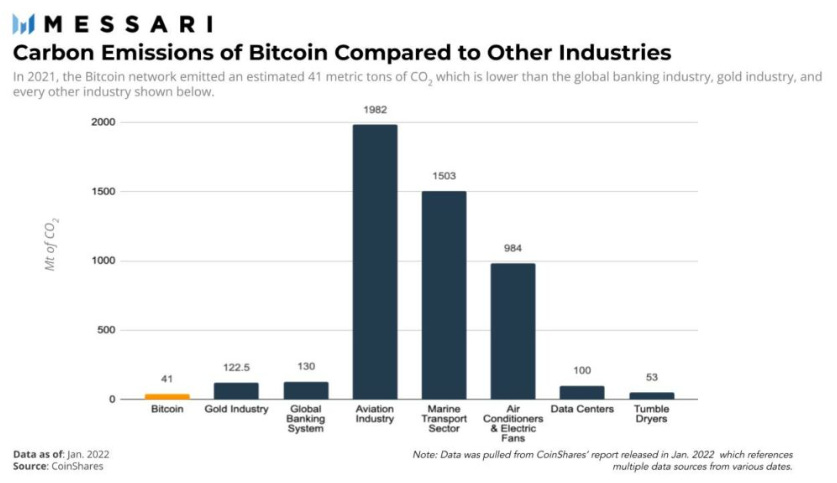

Before I go further, I think it’s important to highlight that most of these criticisms are false or significantly exaggerated, especially when you compare the energy usage of crypto to other industries.

However, the narrative and story will always outweigh the reality, so it’s something that needs to be addressed regardless.

As a smart contract platform, Ethereum’s goal is to become a consensus layer for the internet, enabling global finance, business and commerce to build on top of and integrate into it. However, with a heavy carbon footprint, many companies are unable to use the technology due to government mandates and restrictions.

In addition, gaming and other communities have been vocally against the energy usage required to power NFTs and other digital assets.

While there are many other smart contract platforms in Web3 which are already POS and require little energy to use, the fact is that Ethereum remains the largest smart contract platform in crypto and Web3 by far.

This means that if Ethereum is not a “clean” technology then ultimately “Web3” is not a clean technology either, which stifles adoption and growth in Web3.

Here’s the good news. Ethereum's transition from POW to POS will lower the energy consumption of Ethereum (and Web3) by 99.9%.

This ends the “NFTs, Web3 and Crypto are bad for the environment” story in its tracks and enables any business moving forward to participate in Web3.

Unfortunately, the same can’t be said for Bitcoin. However, that's a topic for another day.

The Ethereum Merge Improves It’s Tokenomics and Security

In this industry we all love “number-go-up”.

Well, the Ethereum Core Dev team does too. This is why a big part of the ETH merge is to improve the tokenomics of ETH the asset, enabling its price to more easily rise.

Now, the Ethereum Core Dev team isn’t worried about the price of ETH because they want their “bags” to grow. They want this because it means a more secure and antifragile blockchain.

You see, the higher the price of ETH, the harder it is for bad actors to perform a 51% attack on the blockchain. The more control someone has over the total supply of the tokens, the more control they could have over the network itself. Thus, the higher we can make the price of ETH, the more resources ($) one would need to buy up control of the network.

Before I break down how the merge will impact the tokenomics of ETH, it’s first important to understand that the price of any asset is determined by its supply and demand. If you have more buyers than sellers of any asset, the price goes up. If you have more sellers than buyers, the price goes down. Very simple.

So Here Is How The Merge Will Impact Supply And Demand Of ETH:

The Merge will reduce the yearly ETH issuance (inflation) from 4.3% to 0.43%.

POS requires much less issuance of ETH than POW to pay for security. So much so that issuance is reduced by over 90%. This is a massive supply shock to the ETH token supply.

The overhead costs of validating Ethereum falls close to 0.

To validate Ethereum in POW it requires significant energy costs and expensive mining rigs. This means that validators (aka miners) are selling a large share of the ETH they earn by securing the network. Estimates are that at least 70% of the 4.3% ETH issuance is sold.

Because POS requires next to no energy or expensive equipment, none of the ETH issuance is considered to be “forced sold” to pay for expenses.

This is also considered a supply shock, as we remove a significant amount of “forced sellers” from the market.

The staking yield (APY) to validate Ethereum will increase from ≈ 4% to ≈ 9 - 12%

With the removal of expensive miners the fee structure is altered to provide more APY to POS validators. Coinbase estimates a jump from 4% APY to upwards of 9-12% APY

This creates a massive demand shock to ETH, as yield chasers will need to buy ETH in order to stake and receive the APY.

This is also a form of supply shock as staking ETH effectively removes it off the market to be sold.

EIP 1559 has burned over $5 Billion in ETH since its launch in 2021

While this feature is already live on the Ethereum mainnet it’s important to note that EIP 1559 adds to the supply / demand story for ETH the asset by burning a % of ETH with every transaction that occurs on the blockchain

So what does this all mean?

The 90% reduction in ETH issuance combined with the ETH burn from EIP 1559 will turn ETH into a deflationary asset. In addition, more demand will be created via increasing the APY to stake ETH and significantly lowering the barrier of entry to participate in validating Ethereum. And finally, a large % of forced sellers which exist from mining costs will be removed from the market.

It means that post-merge, the Ethereum Core Developers will have created one of the greatest tokenomic structures that we have ever seen in crypto and Web3.

The most likely result from this is a sustainable increase in the price and market cap of ETH and thus a more secure network for Web3 to reside on top of.

The Ethereum Merge Births “The Internet Bond”.

WTF is an internet bond, Kyle?

Bear with me for a second. I know this sounds ridiculous and complicated, but I’ll keep it simple.

In the traditional world of finance, there is a term called The Risk-Free Rate. The risk-free rate is the rate of return of an investment with no risk of loss. The yield expected from a US treasury bond (debt offered by the US government) is the risk free rate of the United States financial system (technically the global financial system too).

The reason this is true is that whether you hold US dollars or US treasury bonds, there are (essentially) no additional risks on your assets because they are backed completely by the US government. Should the US government fail, US treasury bonds could go to 0, but so could USD. So there is essentially no added risk to holding US treasury bonds over just holding US dollars itself.

The Risk-Free Rate is important because banks and financial services have a baseline rate they can earn or provide in terms of yield. It allows for many financial services to be built on top of and a place for trillions of US dollars to be parked. It also serves as a benchmark as any yield higher than the risk-free rate has some sort of added risk to it.

ETH is about to create the “risk-free rate” of Web3.

With the transition to POS, you can now earn a risk-free rate on your ETH. Those who choose to validate the Ethereum network by staking their ETH can earn a yield of 4-12% (depending on how many others stake as well). This yield, so long as you don’t use lending platforms or Dapps to stake, is essentially risk-free.

In the same scenario as the USD and US treasury bonds, holding ETH or staking your ETH to earn yield has essentially the exact same risk. This provides a baseline yield for all of DeFI to build on top of and utilise.

While this doesn’t seem like a big deal to most of us, it's important to understand that institutions, banks and even governments love yield, especially yield that doesn’t bring any additional third party risk.

A new financial system and global economy is being built over the internet and for the first time, everyone has an opportunity to invest in it and earn a yield from it. This is a big deal for the overall legitimacy of DeFi, crypto and Web3 at large

You can learn more about The Internet Bond in this article from Bankless.

The Ethereum Merge Is A Big Deal For Web3

Web3 is an exciting space which is growing extremely fast.

However, it’s important to understand that even the foundational layer of this industry is still being built out and improved upon.

Ethereum, as well as other Layer 1 blockchains, are still very new and a work in progress. Which is crazy to think about when you consider that blockchains settled over $16 trillion in transactions last year!

The Ethereum Merge is a huge step in the right direction for this space. In one moment, which appears to be around September 15-16, 2022, the foundational layer of this industry will become a sustainable technology both in terms of its carbon footprint and its profitability and tokenomic structure.

Finally, the Ethereum Merge legitimises Ethereum and Web3 by completing one of the largest technological feats that this industry has ever seen and providing an internet native risk-free rate to the global financial system.

As I’ve been saying in this newsletter all year:

“Don’t fade the merge”

Kyle Reidhead

Founder of of Web3 Academy & Impact Digital Marketing

Twitter

🚀 Action Steps For Web3 DOers 🚀

👉 Do you think the merge will occur as scheduled? Reply to this email with YES or NO!

👉 Reach out to us on Twitter if you want your article featured on Web3 Academy!

👉 Take our FREE Web3 Rabbit Hole Course to get up-to-speed on the foundational components of Web3 so you can confidently build, work, or use the fastest growing technology in history