U.S. Regulation Screws Robinhood, Crypto.com and Causes Major Crash

PLUS: Takeaways From Epic Web3 Conference

GM DOers! 🚀

The US regulation is far from exquisite. 😑

In fact, there’s a war going on against crypto, and the SEC is our main opponent. 🔫

The suits against Coinbase and Binance from last week came with consequences for the wider industry and if you’re on Crypto Twitter, it seems like it’s all over.

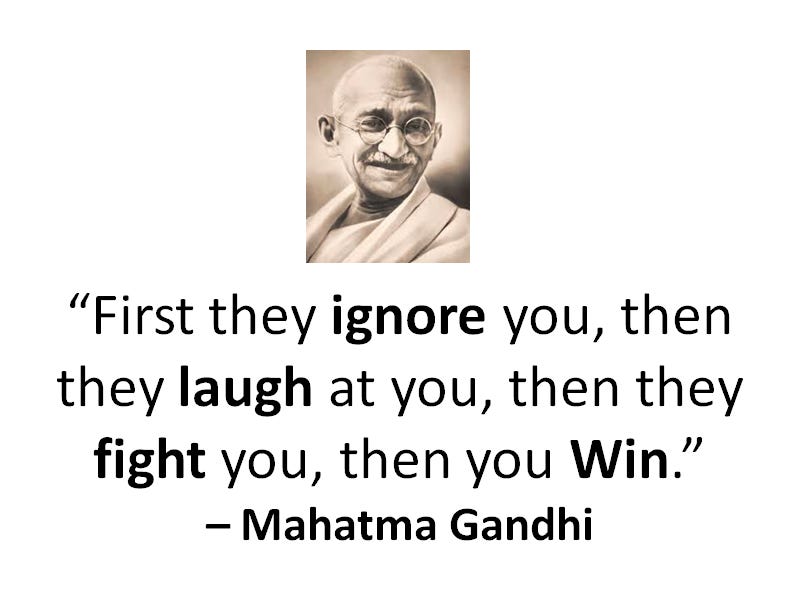

But this isn’t new for our industry. We’ve been fighting regulation and governments ever since Bitcoin came around.

I mean… Maybe not since day 1, because they ignored us back then.

You know Gandhi’s saying…

I’ll let you guess which stage we’re at right now. But as always, we’re here to set the record straight and keep you away from hype cycles. 🚨

So let’s get into what occurred over the weekend and explore how we can get to the then you win stage.

Make sure you stick around until later on. We’ll reflect and share some moments from the Epic Web3 Conference in Lisbon that happened last Friday, as well as some pictures from our community meet up.

Let’s go 👇

👉 Lens Protocol: The Future of Social Media

Decentralized social media finally allows creators to own their content, data and followers. That’s why we choose to build part of our media platform on Lens Protocol.

Where It All Began

Last week, we woke up to the SEC's kind of GMs: A suit against Coinbase and 13 charges against Binance. Read about that here.

TL;DR, the SEC classified the following cryptocurrencies as securities.

And this led to a bunch of crypto companies either delisting tokens or shutting down services to comply with the (VERY UNCLEAR) laws.

Join our Eyes On Chain Session

I will be unpacking the top 5 charts that'll shape the next months in crypto. It's going to be big! 🔥

👉 In Discord, Tuesday (13th June) at 12PM EST.

This is exclusive to our PRO members. So upgrade to PRO, snag your pass, and get in on this action. See you there! 🚀

Crypto.com Shuts Its Institutional Exchange in the U.S.

Crypto.com has (or had) a dedicated platform to institutional players.

This was similar to their main crypto exchange, but had slightly different KYC requirements so that companies were compliant when purchasing crypto.

And now, they’re shutting that platform down, saying that “there is a lack of demand due to the market landscape in the US”.

But the close is most likely to stay compliant with the SEC in these uncertain times where they just sue everybody.

The close will occur on June 21st, at 11:59 EDT.

Robinhood Delisting SOL, MATIC and ADA

Solana, Matic and Cardano counted among the SEC’s classifications as securities.

This led to Robinhood (one of the most used platforms in the U.S. for buying and selling stocks and more recently, crypto) saying farewell to $SOL, $MATIC and $ADA.

The end of these tokens will be on June 27th, 2023 at 6:59 PM ET. Until then, you can still trade these tokens but if you still own them on the deadline, Robinhood will sell your tokens into FIAT for you.

Scary that Robinhood can simply just convert your tokens, right? That’s why you should self-custody!

Blood On The Streets: Liquidations Right, Left and Centre

The SEC congestion didn’t only lead to crypto companies taking action to stay compliant. It is also reflected in the prices of crypto.

On Saturday, prices (especially of the tokens named as securities) slid over 20% in a matter of hours and the total market cap of crypto lost about 100 Billion dollars. 🤯

Not only did prices get rekt (because there were obviously more sellers than buyers) but liquidations started to pop up.

Early on Saturday, $300 Million in futures were liquidated.

And every trader’s set-up looked like this:

By the way… We always emphasize that you should not trade!

What’s the point in trading an asset that goes up 150% a year on average? It doesn’t make any sense.

Why so many do it is beyond me… But let’s see if there’s light at the end of the tunnel for our industry ⏬

🤝 Thanks to our trusted exchange partner, BYDFi.

We believe that we’re in the early stages of a bull run and there’s no better time to buy crypto. This is when you should be practising monthly dollar cost averaging into strong network tokens like Ethereum and Bitcoin. 💪

And if you’re buying it’s important to do so with a licensed and reputable exchange. That’s why we recommend using BYDFi. 🚀

Conclusion

So what’s there left for us? Is there any hope? And the answer is of course, yes.

First of all, $ETH and $BTC were barely hit by these shenanigans. And that’s because they’re not seen as securities.

As far as $ETH holders are concerned, last week was a win for them. But for the wider industry, it’s BAD!

This gives us a really bad rep as an industry overall. And that’s not ideal, even if you’re only holding Bitcoin and Ethereum.

So what’s next?

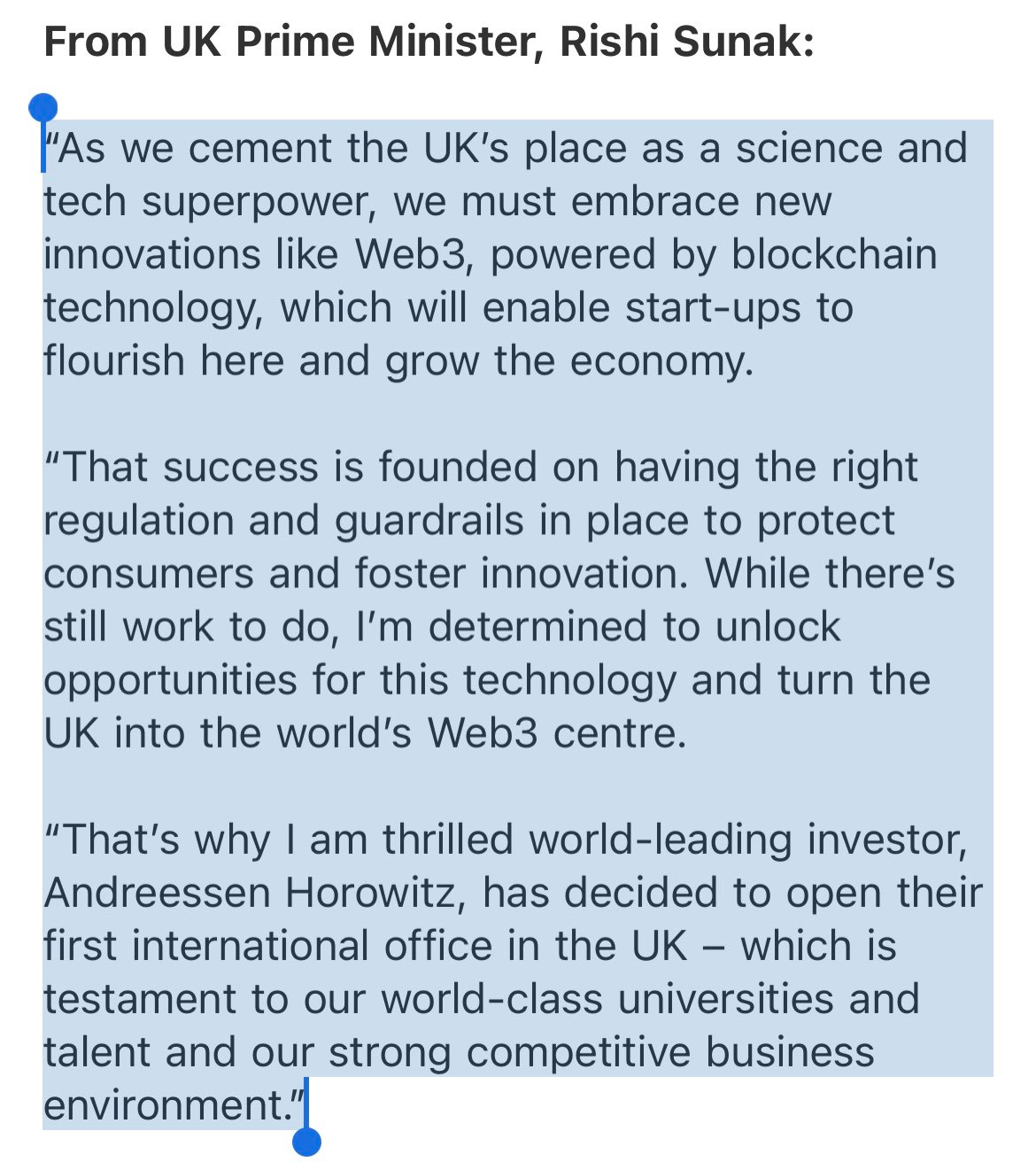

Introducing: Regulatory Arbitrage.

One country’s loss is another’s benefit. While the U.S. is fighting every crypto company, others are calling them to move over to their country instead.

Amid all chaos on Saturday morning, a Hong Kong legislator invited Coinbase over to their region.

And just this morning, a16z announced that they’re opening an office in the UK:

The reason being that the UK sets clear frameworks for blockchain-based companies to operate in the country.

Furthermore, here’s the response from the UK prime minister:

Much friendlier than a lawsuit, am I right? 😛

And this is what regulatory arbitrage is all about. Making the laws accessible to companies so that they move to your country. It’s a win-win.

So, despite the U.S. aggressively bullying the biggest players in this industry, we’re bullish. Why?

Because Coinbase, Binance, Kraken and Crypto.com can simply move to other, more friendly jurisdictions.

A crypto exchange, Huobi is already listed on the Honk Kong stock exchange. So this wouldn’t be a new thing that HK needs to figure out.

P.S- We’ll talk more about Regulatory Arbitrage in our Twitter Spaces today. Make sure you join us for our Space on Twitter at 12PM EST. ✌️

Experience from the Epic Web3 Conference

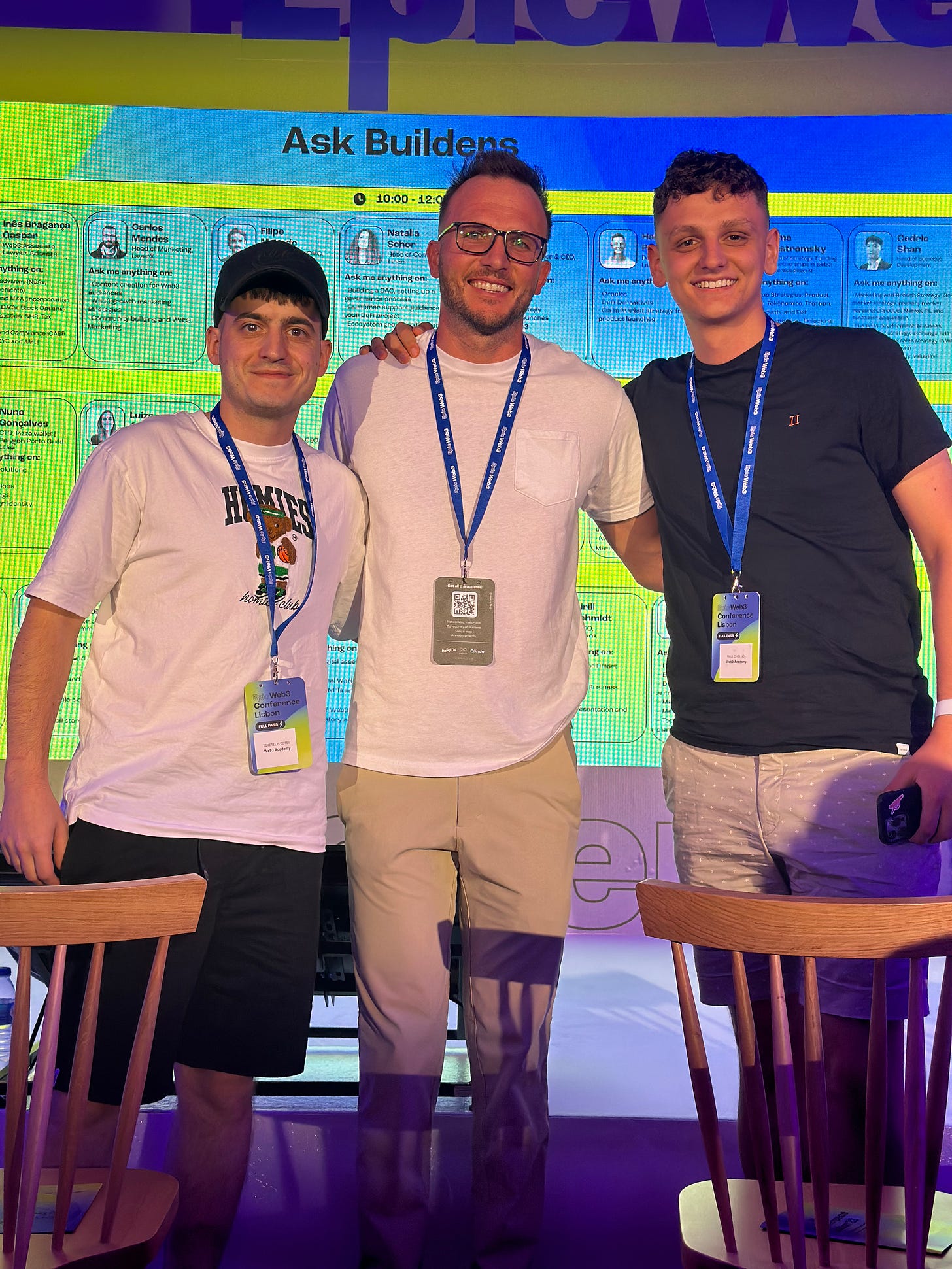

This was the first conference where multiple members of the Web3 Academy team attended. And let’s just say it was awesome…

We’re already planning our next conference. 👀

The Community Meet-up

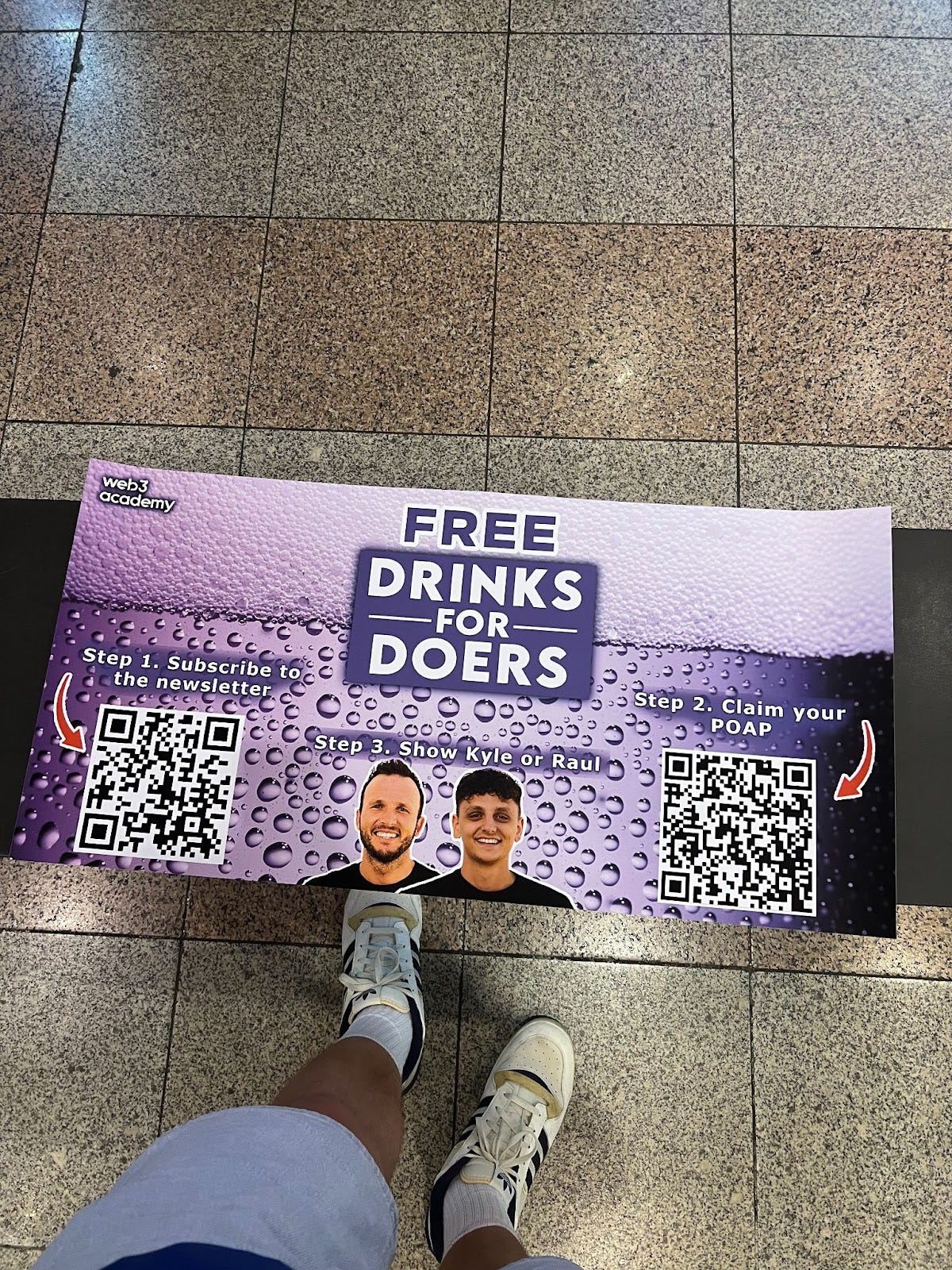

It all started with our community meet-up, where we had a poster:

Everyone who scanned the QR codes and subscribed to our newsletter + claimed their POAPs, got free beer.

We ordered a keg of beer, which we tried to finish from 6pm until 12am. We were unsuccessful…

… despite having an AMAZING turnout…

So… Who did we get to meet?

Alex Pisarevski (the organizer of the Epic Web3 conference)

Vineet Karhail and Matt from Smoothie

Vincenzo Manzon and the Tide team.

Stanislav from Yellow

And our dear community member Paul Martin.

The guys behind Crypto Explorer (an IG page with 600k+ followers)

And so many more… Around 50 people came to our community meet-up on Thursday and we got to meet and network with SO many Web3 DOers…

But how about the conference?

The Conference

Here are some of the most notable speakers:

Nicholas Santomauro from Binance (he wouldn’t comment on current events that are occurring with the SEC)

Matt Medved — Co-founder of NFT Now

Isabel Gonzalez — Co-founder of POAP

Ryan Jones — Director of product at ConsenSys (company behind MetaMask)

Oleg Fomenko — Co-founder of SweatCoin

Alexander Guy — CMO at Zerion

Stephanie Bell — Head of Customer Experience at Uniswap

Yan Ketelers — CMO at PolkaStarter

Boris Spremo — Enterprise Business Development at Polygon

Clement Chaikov — Dfinity (company behind Internet Computer)

Diogo Costa — DeFi Marketing Manager at Ankr

Stefan George — Co-Founder of Gnosis.

And all of the talks were moderated by yours truly:

Our Takeaways

IRL conferences are where you meet the most awesome DOers in this space. If you’re only networking on Twitter, you’re doing it wrong and you’re missing out.

The people in this space are super kind, straightforward and smart.

We desperately need to improve the way we speak at conferences. Most speakers focused on the features rather than the benefits and even we got confused at times… We need to simplify this space so every normie understands the benefits of adopting web3.

Our focus should be more on the UX. Whenever we got the chance, we asked the people who are building in this space about their focus on UX. Unfortunately, we didn’t get the vibe that people are 100% focused on UX, but rather on making other features come to life. This isn’t a bad thing, but we need more UX-focused people in order to take this space to the mainstream.

Alcohol helps. Our community meet-up started off slowly. But as soon as people got a few beers inside, it all opened up. Contacts were exchanged, people were speaking to each other, everyone was taking photos and we all felt like a good bunch of old frens.

We need to do this again. Not only did we meet people BUILDING in this space, we also met our community members who read this newsletter every time it’s sent to them. It was awesome to see and we want to do this more often.

So tell us… Which conference should we go to next? And where will we see you? Reply to this email with your answer!

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

See you soon. ✌️

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.

Nice to meet you guys, great conference 😎 See you at the next conference!

Amid all the crypto craziness, awesome to hear the meetup went well. Agreed, the best way to connect more deeply with people in the space is hanging out IRL! Can't wait to attend another conference soon and do exactly that.