Venmo is Onboarding the Masses: Fintech as The New Crypto On-ramp

77 Million Americans Enter Crypto Thanks to Venmo

GM DOers!

We’re onbooooardiiiing! 🚀

Venmo, the US-focused mobile payment platform owned by PayPal, has just opened the crypto floodgates for their 77+ million American customers.

Two years after Venmo originally announced the option for users to buy, sell and hold cryptocurrencies, Venmo customers will now also be able to send and receive crypto to and from other Venmo & Paypal accounts, as well as external crypto wallets.

This is a huge deal, and we need more of this because enabling as many people to acquire and use crypto in the easiest and most comfortable way possible is exactly how we’ll onboard the next billion users. 🌍

So today, let’s talk about why we need all the web2 onramps we can get, what companies are taking the steps in the right direction, and why is it taking them so long (it should be simple, right?).

Let’s dig in! 🕵️♀️

👉 Lens Protocol: The Future of Social Media

Decentralized social media finally allows creators to own their content, data and followers. That’s why we choose to build part of our media platform on Lens Protocol.

Why This Is a Big Deal

(Do you hold crypto with fintech companies like Venmo, Stripe or Revolut? Let us know by replying to this email with Yes/No 🙏)

Effortless crypto access

Venmo's integration of crypto (only $BTC, $ETH, $LTC, and $BCH are available so far) provides an incredibly simple and familiar way for their users to buy, sell and move these digital assets.

As people gain exposure to crypto, they’ll become more invested and interested in the technology, which can lead to a deeper understanding and appreciation for its potential as they go further down the crypto rabbit hole.

A perfect example of this can be found within our own Web3 Academy team!

Raul, our social media manager, first bought Bitcoin through Revolut (another fintech company) without knowing much about it. A friend had mentioned crypto as the next big money-maker, so he took a leap of faith and aped in. 🤑

Once he was financially invested, Raul felt compelled to learn more about crypto and how Bitcoin works. This curiosity ultimately led him to a deeper understanding of the technology and a full-time passion.

By making crypto more accessible, platforms like Venmo can encourage users to take that first step, opening the door to a world of learning and understanding. 🧠

Of course, as a reader of this newsletter, you already know something that the rest of the world doesn’t - you’re ahead of the curve. 😉

In case you’re wondering how to buy and sell cryptocurrencies on Venmo, below you’ll find a video explaining how. And to learn how you can send and receive crypto using Venmo, follow this link.

Merchant payments with stablecoins

This is where things get really exciting!

Venmo's business users will now be able to offer customers crypto as a payment option, but with a limited selection of volatile assets, it might not be ideal for transactions.

However, if Venmo added support for stablecoins, businesses could accept non-volatile, crypto-native dollars that live on the blockchain, opening doors for massive adoption. 💥

With stablecoins in Venmo accounts or self-custodial wallets, users could effortlessly purchase goods from businesses. Imagine buying coffee or sneakers at a physical store using your MetaMask wallet with $USDC on it! 🤯

This bridges the gap between die-hard crypto users and businesses: no compromise on self-custody, and no need for businesses to set up wallets – just use their Venmo account to accept crypto.

As this functionality becomes more widespread, transacting with stablecoins will become standard practice, whether through custodial accounts like Venmo or traditional crypto wallets.

If you want to learn more about stablecoins, which ones are the safest, and why stablecoins are playing such a critical role in the adoption and use of blockchains, check out our latest PRO Report where we delve deep into the topic!

Web2 Services and Crypto Adoption: What's the Holdup?

Fintech companies like PayPal, Venmo, Revolut, and Stripe have started integrating crypto features into their services, and it's about time!

But what's taking them so long? 🤔

Two main factors play a role: public perception and legal hurdles/uncertainties.

Public perception 👀

Payments companies hesitate to risk their highly profitable businesses by engaging with "risky" and "unpopular" cryptocurrencies, especially after the very public collapses of projects, exchanges, and services in crypto we’ve seen in the past year (think Terra Luna stablecoin collapse or crypto exchange Voyager and FTX bankruptcies)…

While many within these companies likely understand the potential of crypto, public opinion still matters.

Legal hurdles ⚖️

The bigger obstacle is the lack of regulatory clarity, especially in the US.

As we discussed in the last week’s newsletter, US regulators have struggled to provide a clear framework for cryptocurrencies. This uncertainty makes it difficult for crypto-native companies to operate and discourages traditional web2 companies from embracing crypto.

Until there’s more regulatory clarity about how to legitimately operate any kind of product or service that involves crypto, adoption from companies will, unfortunately, keep on lagging. 🚧

Venmo’s moving forward

Despite all that, Venmo is plowing onward, as it’s realized the enormous business potential that offering crypto services holds.

By providing access to cryptocurrencies for 77 million Americans, Venmo has created a new avenue for business growth and increased revenue.

Venmo's main source of income comes from fees.

As more users turn to the platform for buying, selling, and transacting in crypto, the company stands to profit even more – which is a key motivation for introducing this feature.

Venmo simplifies the process for newcomers to explore the world of crypto while simultaneously boosting its revenue through fees – a win-win scenario for everyone! 🤝

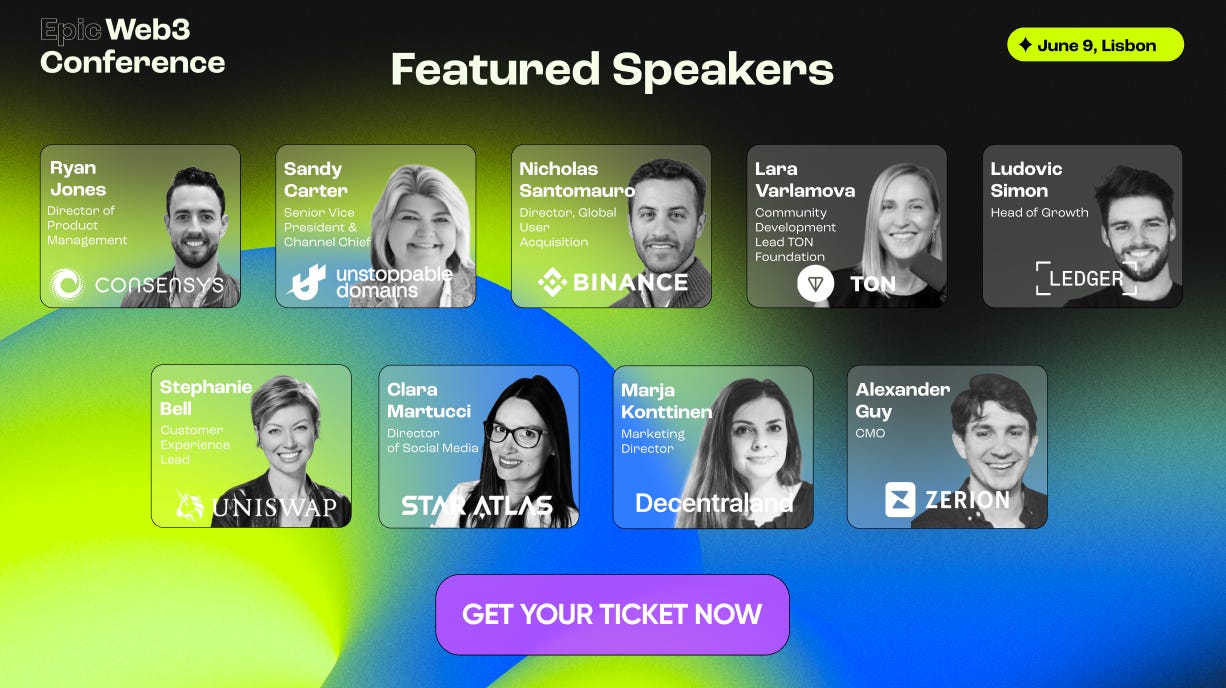

🤝 Together with Epic Web3 Conference: A get together of web3's brightest minds 💡

Join Web3 Academy at the Epic Web3 Conference (Lisbon + online) and hear from people working at leading web3 brands such as ConsenSys, Polygon, Binance, Ledger, Uniswap, and more.

We've got a 15% discount for you, but ticket prices go up every few days. Enter the promo code WEB3ACADEMY15 to secure your spot!

Crypto Adoption by Fintech/TradFi is Great, But…

Self-custody still remains a significant pain point. 🔐

For instance, PayPal, Venmo, and Revolut still don't allow users to fully self-custody their crypto holdings. This means that you don’t have access to your seed phrase.

And you know what they say: not your keys, not your crypto.

Naturally, this implies that on Venmo, you don't actually possess a wallet – just a screen displaying your $BTC/$ETH balance. There's no way to verify its existence by 👀🔛⛓.

When transferring crypto between Venmo accounts, it's probable that the blockchain isn't even involved – Venmo simply adjusts internal records.

However, when sending funds to a genuine crypto wallet, Venmo is compelled to conduct an onchain transaction.

Still, Venmo's decision to enable crypto transfers represents a major leap for mainstream adoption.

While we might nitpick about custody, the real focus is on raising awareness. Now, over 70 million Americans will be exposed to crypto, and countless individuals may go down the rabbit hole, just like Raul. 🐇

With all this adoption happening, crypto is still shrouded in a lot of mystery and can be confusing for many.

At Web3 Academy, we are committed to providing you with the knowledge and tools necessary to help you onboard confidently into web3 and capitalize on the opportunities.

So make sure you don't forget to do your part by sharing our content with those who require assistance in navigating and understanding the web3 landscape. 😉

DOers be DOin’! 🫡

What’s New In Web3?

A virtual Eva Herzigová has become the metaverse's first supermodel.

How Bored Ape creator Yuga Labs plans to get to the 'Otherside'.

Fidelity doubles down on metaverse with financial literacy experience.

Game designers take baby steps toward web3 vision.

🟣 Hold on, DOers!

Web3 excellence doesn’t come easy: it's time for homework! 💪🤓

WEB3 PODCASTS FOR BEGINNERS

Struggling to get a grip on web3? Don’t know where to start? If you’re reading this, you’re already ahead of the curve. 😉

To help you onboard confidently into web3, we've assembled a beginner-friendly Spotify playlist that you can binge through while cooking, working out, or commuting. Check it out!

LISTEN

🎧 Join us in our recent DOer Spotlight episode where Jay is joined by Max Howell, the CEO of Tea.xyz, to discuss the issue of open-source code compensation and his solution to the problem. He also shares his interesting views on AI and how it is impacting our lives. Tune in now! 🔥

Thanks for reading and we’ll see you on Wednesday! ❤️

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.