W3A PRO | A Framework To Successfully Invest In Web3

Capitalize On The Upside Of Crypto Without Being A Professional Investor

GM PRO DOers!

The world of cryptocurrency and other high-volatility asset markets represents a potential gold mine of profit. 💰

Averaging an appreciation of 150% per year, crypto outpaces traditional investment avenues by a significant margin. 📈

However, most people end up losing money in crypto. How can that be possible with an asset that increases 150% per year? 🤦

This discrepancy stems from several key factors including greed, lack of understanding, susceptibility to FOMO (Fear of Missing Out), excessive use of leverage, risky yield farming, inadequate security measures, and improper market timing.

At Web3 Academy, we're focused on building and creating a better future for everyone, but we still want to capitalize on the upside.That’s why we are teaching about investing. 🚀

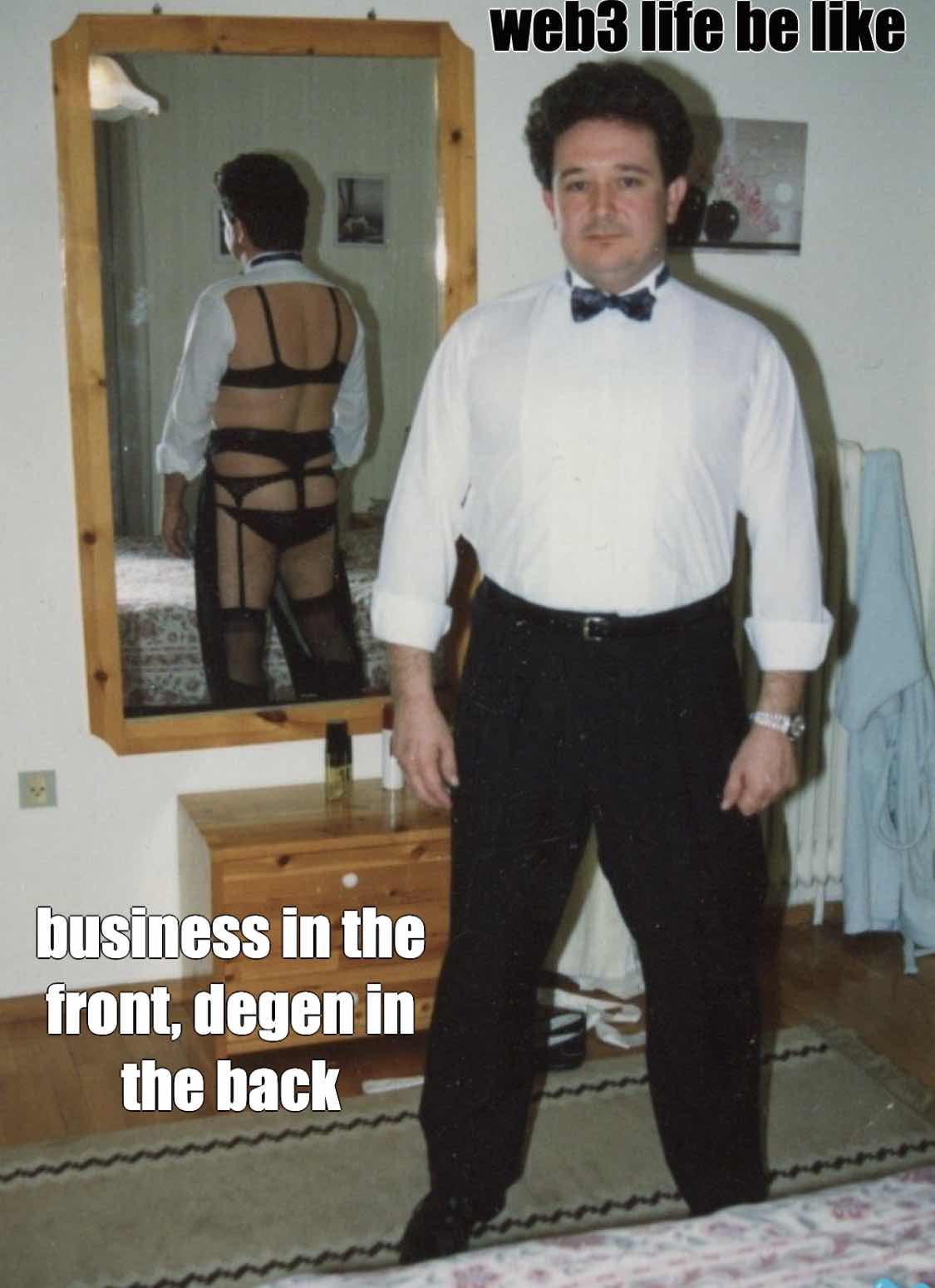

In a way… You could say this is us:

Except rather than “degening”, we invest with a smart framework to protect our investments and ensure we capitalize on the incredible upside of web3. 💪

So.. In today’s report, we want to equip you with a robust framework for investing in volatile assets, turning potential pitfalls into opportunities for sustained financial growth. 🤑

Here’s our agenda:

Why do investors lose money in volatile markets ❓

What are we investing in and how do markets work? 📊

Secular vs cyclical trends 🔄

Time in vs timing the markets ⏰

Setting up your portfolio for long-term success 🎯

By the way, this report is a summary from a live event we held in our Discord on Tuesday. Thanks for those who turned up, the feedback from you was amazing!

For those that had issues joining the call, we’re sorry! Discord was limiting us to 25 people. We’ve figured out a solution for our future events and will be hosting more soon! So keep your eyes peeled and join the Discord here if you haven’t already!

FYI free members can attend the sessions, however only PRO members get to join the exclusive AMA session afterwards.

One more thing before get into today’s report. We’re building a Web3 Investing Course, and this report is the intro of that course. Now, we really want to build a resource that solves your problems and ensures you capitalize on the opportunity.

So, please reply to this email with:

Yes or No – If a course about investing across web3 is something you are interested in.

Questions you want us to answer inside the course.

This will really help us design this resource for YOU (because that’s the whole point anyway). 🫵

Okay… Enough babbling. Let’s get into today’s report ⏬

Why Do Investors Lose Money in Volatile Markets ❓

Most experienced traditional investors can achieve returns around 10% a year, with top-tier investors like Warren Buffet hitting around 15%.

If you only invest in the S&P 500, that gives you around 10%/year (the average over the past 50 years).

Yet, crypto, a high-volatility asset class, yields much higher, 150%/year on average.

This remarkable profitability, however, comes hand-in-hand with significant price fluctuations, making the troughs just as dramatic as the peaks (as you can see on the chart above).

Therefore, understanding market dynamics AND the multitude of factors, which often lead to investors losing money in these markets is crucial for investors navigating the turbulent waters of crypto.

So let’s start with understanding the reasons why investors lose money in crypto: