GM DOers!

Billions worth of $ETH are about to break loose! 😱

Are you wondering what Ethereum's upcoming Shanghai upgrade means for the future of the network and the market?

The Shanghai upgrade, set to take place today, has one key feature that's got everyone talking: the ability for validators to finally withdraw their staked $ETH.

This change will unlock a significant portion of the total $ETH supply, leading to speculation about what stakers will do with their newly unlocked assets.

In today’s newsletter, we'll dive into the details of the Shanghai upgrade and staking on Ethereum, discuss the potential impact of unlocking billions of dollars in staked $ETH, and explore the different scenarios that could play out when validators make their move.

Ready to dive in? 🌊

👉 Lens Protocol: The Future of Social Media

Decentralized social media finally allows creators to own their content, data and followers. That’s why we choose to build part of our media platform on Lens Protocol.

Shanghai Upgrade and Staking on Ethereum

(Are you staking your $ETH? Reply to this email with Yes or No 😉)

The upcoming Shanghai upgrade is a major hard fork scheduled for April 12, 2023.

This hard fork is highly anticipated because it will enable validators to finally withdraw their staked $ETH, which has been locked up since staking was introduced in December 2020. 🔓

For context, this locked-up $ETH accounts for about 16% of the total ETH supply, currently valued at ~$37 billion dollars. 💰

Staking (validators locking up their $ETH) is essential for Ethereum Proof-of-Stake network’s operation as it helps secure it while offering them staking rewards in return.

To learn more about staking and staking services on Ethereum, we recently published a PRO Report on Staking-As-A-Service, A New B(Tri?)illion Dollar Industry, where we dive deep into the economics and future of staking.

While a 16% staking ratio (% of total supply being staked) might not seem like much, especially compared to those of other PoS blockchains (40-73%), it’s important to remember that Ethereum has the 2nd largest market capitalization ($231 Billion), giving that small % a lot more weight (in dollar terms) than for other smaller chains.

In the following chart, you can see that the 13% $ETH stake still exceeds the combined stakes of the smaller blockchains, even with their staking ratios being higher.

This means that even with a relatively small % staked, the network security (represented by the total value of the staked asset) is still the highest among all PoS chains.

What’s more, the Ethereum network has managed to maintain consistently high staking rewards (6.8%), which are the $ETH rewards paid out to stakers for helping secure the network.

Ethereum is unique in this regard because it’s been able to offer these rewards without externally subsidizing them or inflating the token - something that other blockchains have not been able to achieve.

If thought of as a business, Ethereum can be considered the only profitable (i.e. sustainable) business among all blockchains.

To learn more about how blockchains are able to support themselves, check out our PRO Report where we dive deep into the business of blockchains.

But if the staking rewards have been so high for such a sustainable and massive blockchain, why has the staking ratio been so small?

Well, it’s because withdrawals have not been possible for the past 3 years, and many potential stakers have been left on the sidelines due to the uncertainty of not knowing when their $ETH would be unlocked.

That, of course, is a perfectly reasonable concern!

But now that the upgrade ($ETH withdrawals!) is around the corner, it begs the question - what’s going to happen after it?

What This Upgrade Means for Ethereum

There’s been a ton of speculation about the withdrawal impact on Ethereum.

While there are good arguments on both sides, we believe that this upgrade is very bullish both for the network and the price.

But before we talk about the bullish case, let’s quickly address the bearish one, which is largely resting on the confusion about how the withdrawal process will take place.

The Bear Case

The reality is that the withdrawal process might take weeks to fully complete, so not everyone will be able to get their unlocked $ETH immediately.

This is due to the withdrawal mechanism design and bandwidth limitations.

Because of this, it’s highly unlikely that a rapid selling spree will follow, which could tank the price.

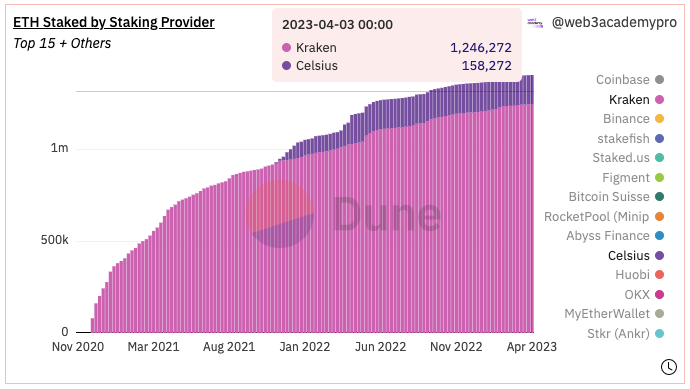

Another thing to keep in mind is that exchanges like Kraken, facing regulatory pushback on their staking services, and Celsius going through bankruptcy, will be forced to unstake their $ETH.

While it doesn’t imply that they would be forced sellers (at least in Kraken’s case), it’s important to keep this in mind, as together they are staking a decent amount of $ETH.

If these exchanges end up selling their unlocked $ETH, this could indeed result in at least a temporary bearish scenario, as it would be a lot that would once again go into circulation.

However, the price decrease due to these forced sellers will likely be seen as an excellent opportunity to buy more $ETH, rather than any fundamental negative shift in the market sentiment.

Now, let’s get bullish, shall we?

🤝 Together with Epic Web3 Conference: A get together of web3's brightest minds💡

Do you want to hear from people working at leading web3 brands such as ConsenSys, Polygon, Binance, Ledger, Uniswap and more? Then you need to attend the Epic Web3 Conference in Lisbon (or online), on the 9th of June!

Want to join us? We've got a 15% discount for you, but ticket prices go up every few days. Enter the promo code WEB3ACADEMY15 to secure your spot!

The Bull Case

The lack of withdrawals (not being able to unstake locked up $ETH) has been one of the main reasons why big players such as institutions and other investors have not dipped their toes in staking on Ethereum.

Now that the floodgates are about to be opened, we could see an influx of institutions getting in on the action.

This will not only result in increased network security but also a reduced circulating supply as the staked $ETH will get locked up, making purchasable $ETH more scarce, driving up the price.

Lastly, this upgrade is good news for decentralized staking protocols (and users!).

Many stakers (validators) have been using centralized exchanges to stake their $ETH, even though they get smaller rewards due to the exchanges taking a cut.

Whereas if they were to stake on a decentralized staking service such as Rocket Pool, they could be collecting a much higher reward without having to trust an exchange to custody their $ETH.

Withdrawals will likely be the last push needed for validators to move their $ETH off exchanges and into decentralized staking. Yay decentralization and max rewards!

To find out more about the opportunity of earning rewards by staking $ETH on Rocket Pool, check out our recent PRO Report where we analyze this decentralized staking protocol and its $RPL token.

At the end of the day, the Shanghai upgrade is a huge milestone for Ethereum's ongoing development and growth, and it wraps up the first stage of Ethereum’s roadmap, the Merge.

So regardless of what happens in the very short term, the future prospects of Ethereum are more promising than ever, as the team keeps on delivering on promises, paving way for an open and decentralized future we’ve all been hoping for.

Once again, DOers keep on DOing! Onwards! 🚀

What’s New In Web3?

Sound.xyz, a web3-native music platform, is fully opening its doors to all artists, marking a huge step for the platform and the music NFT ecosystem.

a16z, the well-known venture capital firm, has released its annual 2023 State of Crypto Report, which documents all of the developments and progress made in web3.

Reddit just dropped thousands more NFTs (digital collectibles, as they call them) on Polygon from over 100 Artists.

Borrowing Against NFTs Is Now a $1 Billion Industry—What’s Next?

🟣 Hold on, DOers!

Web3 excellence doesn’t come easy: it's time for homework! 💪🤓

EXPLORE

Want to learn more about how to stake your $ETH? Check out this comprehensive guide by MilkRoad that covers the staking process and best platforms in detail.

And once you’re done, make sure to put your $ETH to good use and stake it, thus helping secure the Ethereum network and earning some rewards in return! 😉

LISTEN

Check out our latest debate, where Jay and Kyle discuss the evolution of the web from its early days to the present time, focusing on the emergence of blockchain and AI technologies, and debating if artificial intelligence could be considered part of web3. 😉

Thanks for reading and we’ll see you on Friday! ❤️

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.