W3A PRO | Is Web3 Dead or Are We About To Go Mainstream?

An Inflection Point Of Adoption, Innovation and Markets Is Brewing

GM PRO DOers!

Do you feel like crypto is dying?

I don’t blame you if you do!

If we only follow Crypto Twitter and the mainstream media, it certainly looks like this industry is on its last breath.

And thanks to the SEC crackdown on cryptocurrencies lately, it feels like that might be the final blow.

But let’s get out of the weeds. The truth is that we’ve been fighting regulation for years.

Ever since crypto has gained adoption and popularity, various governments and government agencies around the world have been trying to shut us down. They’ve always been unsuccessful.

As we talked about in Monday’s newsletter, referring to Gandhi, the common cycle is:

First, they ignore you

Then they laugh at you

Then they fight you

Then you win

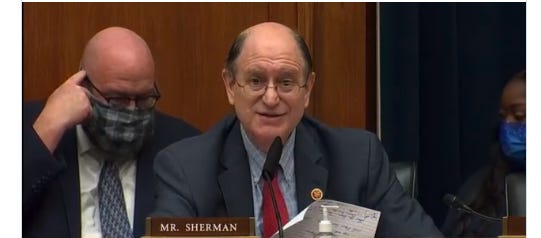

They used to laugh at this industry, with Congressman Sherman calling Mongoose coin the next big thing:

Now they’re fighting us by going after the biggest players (Coinbase, Kraken, Binance, etc…)

But that’s okay. The reality is that nobody is able to stop permissionless and decentralized protocols, so long term, we’ll be just fine.

But what about the short term? Is it really as bad as it seems?

I wouldn’t say so… Sure, some centralized exchanges will be rekt, and so will a few cryptocurrencies that actually act as securities and don’t comply.

However, when you look deeper, aka onchain 👀🔛⛓️, things don’t seem too bad. I took a peek under the hood and I (as usual) became as bullish as ever.

I think that we’re nearing an inflection point of adoption, technological innovation and a macro set up which is creating an opportunity similar to that of early 2020.

In 2020 we had a macro backdrop of excess liquidity entering the system (good for risk assets), technological improvements across blockchain tech in the form of Defi applications and NFTs, which together set up a cycle of exponential adoption throughout 2020 and 2021.

Today, it feels like the same scenario is happening and it’s just a matter of time until everything comes together to spark another bull market like we’ve seen in previous cycles..

So, today, I want to present some onchain metrics that showcase a bullish overview on the state of adoption and tech innovation, all from building in the bear 🐻

I’ll hold off on the macro talk in the report as I will do a Market Watch deep dive in the PRO report coming out in 2 weeks from now, which I will also host a live event in the discord beforehand on June 27th at 12pm EST (set this to your calendar folks!)

By the way, speaking of live events, this report comes from the back of the PRO Eyes On Chain event we had on Tuesday in our Discord.

It was a great turnout of PRO members. If you couldn’t join, that’s okay! We recorded the meeting and made it available just for you.

The link is below the paywall (sorry free members, if you want to access these events + our weekly PRO reports, please go PRO here)

To wrap up this intro, I’m about to cover the top 5 themes I’m watching right now that lead me to believe we are reaching the inflection point. Those points are:

1. A look at liquidity on exchanges

2. A deep dive into how the industry is going bankless

3. A new onchain industry which is BOOMING

4. Some examples of real use cases gaining real adoption onchain

5. Blockchain tech that is primed for mass adoption