W3A PRO | This Crypto Cycle Is Different Than The Others

Eyes Onchain Report: Top Charts in Web3

GM DOers!

“Same, Same, But Different”

That’s how I sum up today’s eyes onchain report.

History looks to be repeating itself in the crypto markets once again. The next cycle could be upon us. 🔄

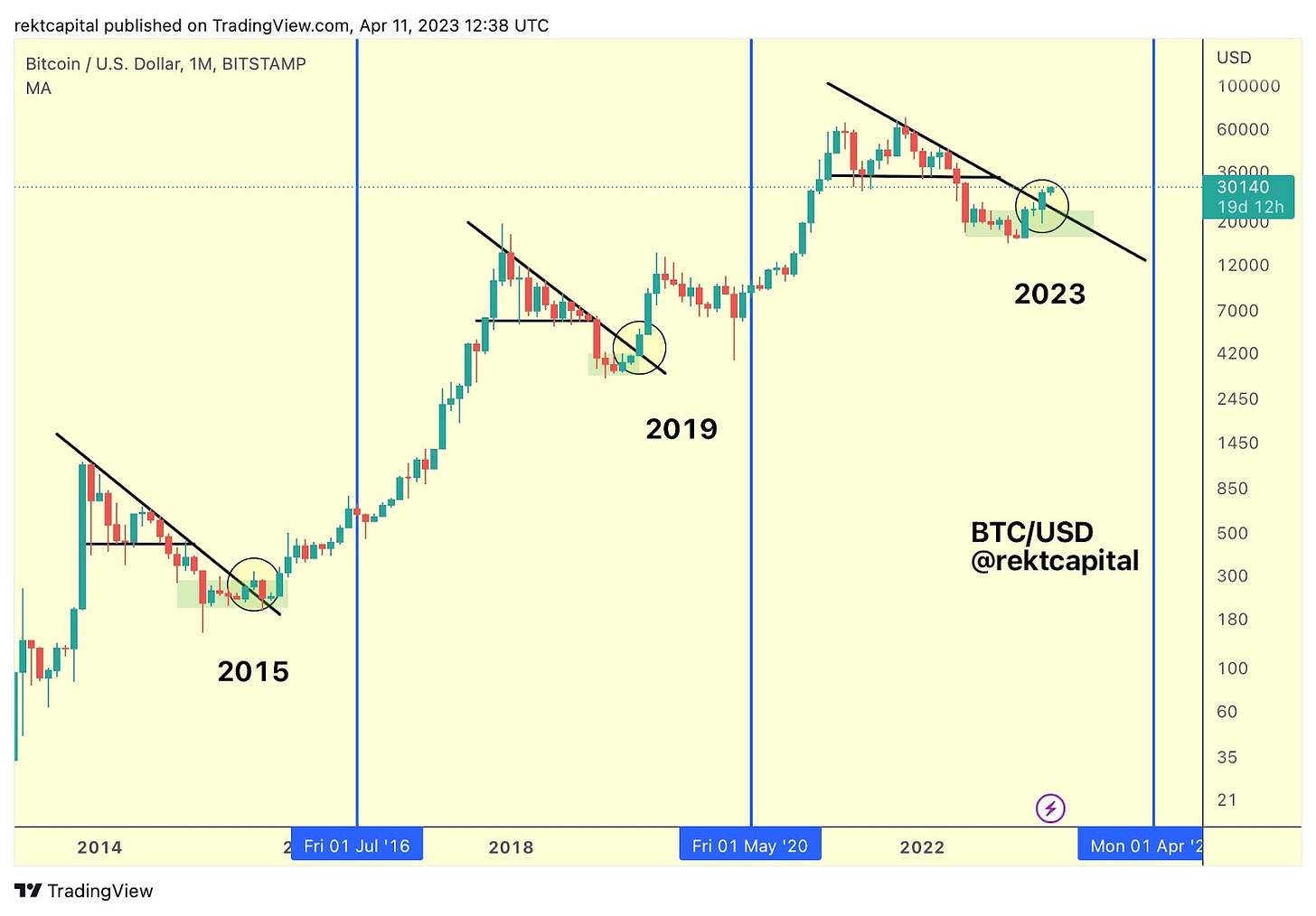

📊 We can see it pretty clearly here in the chart above made by Rekt Capital, an OG technical analyst in the space.

But this time, things are different™.

If we are entering the next crypto cycle, then we are doing it from a different place than we ever have before. This could be a REALLY good thing for this industry. 💪

I’m going to share some onchain charts that show what is different about this cycle vs. the others.

But before I do, here’s where my head is at regarding all of this. 🤔

Back in 2020 before the last crypto bull run took off 🚀, I was getting very excited about Bitcoin, Ethereum, and their capabilities. Of course, I was very excited about the potential money to be made too. 💰

This was before crypto was all over the media headlines and your friends and family were asking if they should invest in the next dog coin, just like crypto is today.

The incoming cycle that ensued blew my mind and was bigger and wilder than I had ever imagined. 🎢

Who could have predicted Monkey NFTs worth millions and FTX blowing up? 💥

Thankfully, I invested my capital into the space as well as my time studying it before the market took off.

That allowed me to do quite well financially, but, more importantly, it kept me from losing money and getting caught up in the hype cycle, and helped me start a business in the space to generate revenue streams.

I definitely made some mistakes along the way - it wasn’t perfect. 🤷♂️

But I came out of that cycle much farther ahead than before. Many are unable to say the same. It’s about survival just as much as it is about building and investing.

These cycles provide life-changing opportunities for investors and entrepreneurs, however, you need to go into them with a plan. 📝

That’s exactly what we are trying to do with our PRO members.

We want to help you allocate into the right assets early 🎯 as well as differentiate the fads from real innovation, so you can successfully build, invest and capitalize on the opportunities in this space long-term.

Today, I am just as, if not even more excited for what is to come for web3 than I was back in early 2020. I think the opportunities right now are massive. 🤯

That said, I’m one of the few who are extremely bullish on this space right now. Most people are bearish on macro 🐻, bearish on the economy, and bearish on technology in general because of inflation, high interest rates, regulation, and more.

I've explained my thoughts on the macro side in previous PRO Reports. Last week, we also looked at some onchain metrics in terms of market analysis. Today we’re going back onchain.

We’re going to look at the innovation and adoption which has occurred during this bear market.

During previous cycles, innovation and adoption metrics dropped along with the price. 📉

However, this cycle's bear market seems to break that pattern. As we approach the next hype cycle (whenever it arrives), we're entering a whole new era. 🚀📈