How Blur is Changing the NFT Game Forever

Blend: Redefining How We Borrow and Purchase Digital Assets

GM DOers!

NFTs are so illiquid, they make real estate look like a glass of water 💧

Damn… I wanted to say that for a very long time 😅

And I’m glad I did, because, after today, I may not be able to have illiquidity and NFTs in the same sentence again.

Meet Blur’s latest product: Blend 👉 a brand new peer-to-peer NFT lending platform introduced a couple of days ago that allows users to:

Secure a loan of up to 42 $ETH against their CryptoPunk.

Purchase an Azuki (17 $ETH Floor Price) for a mere 2 $ETH down payment and pay the remaining balance later.

Now this dilemma:

Turns out to be no dilemma at all:

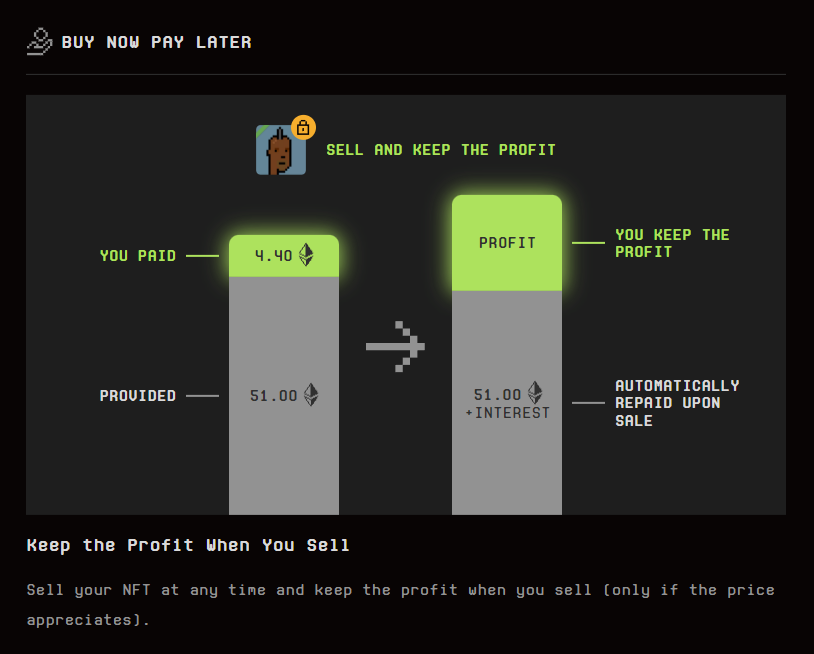

Just as car buyers make a down payment on a vehicle and then pay off the remaining balance with monthly installments, Blend enables collectors to adopt a similar approach in the NFT market.

They can put up a portion of the full NFT price as an initial payment, and then gradually cover the outstanding balance over time ⏳

This is huge in so many ways. But before we explore how Blend works and how and if Blur’s making money from this…

…tell us 👉 is the launch of Blend going to kick-start another crazy NFT pump? Reply to this email with Yes/No 📧

👉 Lens Protocol: The Future of Social Media

Decentralized social media finally allows creators to own their content, data and followers. That’s why we choose to build part of our media platform on Lens Protocol.

Blend: What is it and what does it do?

Short for Blur Lending, Blend is a peer-to-peer perpetual lending protocol that allows users to either:

Take a loan (in $ETH) by putting an expensive NFT up for collateral

Buy an NFT right away by providing a small down payment (less than 10% of the total value of the NFT) and pay the rest later.

At the time of writing, you can only use Blend for three collections: Azuki, CryptoPunks and Milady, but Blur promised more collections to be added very soon 🔜

So, how do Blend loans function? 🤔

Blend loans come with fixed interest rates and no end date ⏱️

This means borrowers can pay back their loans whenever they want.

On the other hand, lenders can choose to exit by starting a Dutch auction to find a new lender.

In a Dutch auction, the bidding starts at a high price and gradually decreases until someone makes a bid 📉

If the auction doesn't succeed, the borrower's collateral gets liquidated, and the lender takes possession of it.

Blend's unique approach allows interest rates and borrower liquidations to be determined by market forces 📏

During a Dutch auction, if no one is willing to take over the loan, despite the increasing interest rate, it indicates that the borrower's collateral is valued less than the amount lenders require to lend money.

This system is designed to safeguard lenders from lending money against an NFT (collateral) that loses its entire value 🛡️

If you’re confused about how lending/borrowing works on Blend, feel free to read the whitepaper. They explain it thoroughly in there!

But let’s not be sad and gloomy. Let’s forget about liquidations for a sec and focus on making profitable trades.

If you do want to book the profits, you can simply sell the NFT, repay the loan (+interest), and keep your (digital) cash. 🚀

Pretty neat.

Is Blur Pivoting Away From NFT Traders?

TL;DR: Nope ❌

Blur is and still remains a platform for traders. While this may sound like Blur wants to appeal to mainstream tech adopters, that’s not the case.

Simply ask yourself: Would a normie take a loan (onchain) to buy a JPEG? Probably not 🤷

Blend will mostly be used by degens who can now ape into NFTs with leverage. 😂

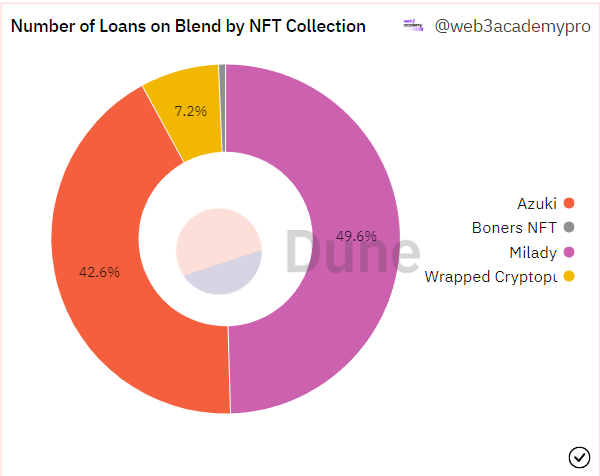

In fact, after less than 48h since Blend went live, there are:

640 Miladys

518 Azukis

88 CryptoPunks

All currently owned on leverage (most with 80% or more of the total NFT value) 🤯

At the time of writing (~2h before the release of this article), there have been a total of 1,200 loans made between 408 borrowers and 310 lenders (wallets, not people).

Together, these loans accrue to 12,800+ $ETH borrowed (~$24M) 😨. Remember. It’s been less than 48 hours.

While it’s good news that NFTs finally have some liquidity, it’s still scary to think that so much $ETH is being borrowed against very volatile JPEGS.

If you want to follow (👀🔛⛓️) the live onchain activity on Blend, check out the bottom of this article where we share a dashboard that we’ve just put together.

🤝 Together with Epic Web3 Conference: A get together of web3's brightest minds 💡

Join Web3 Academy at the Epic Web3 Conference (Lisbon + online) and hear from people working at leading web3 brands such as ConsenSys, Polygon, Binance, Ledger, Uniswap, and more.

We've got a 15% discount for you, but ticket prices go up every few days. Enter the promo code WEB3ACADEMY15 to secure your spot!

Great Onchain Activity… But Is Blur Finally Making Money?

If you’re a PRO Member, you’d already know by now that Blur doesn’t make any money with its trading platform, as they charge 0 fees.

In other words, they have no business model (yet). 😬

We wrote extensively about $BLUR, its business model, and its tokenomics in two of our past PRO Reports:

Go PRO & check em out 👆

After reading the Blend whitepaper, we got excited because, at the end of it, they mentioned something about charging fees. 🤩

Our excitement was quickly broken as we learned that Blend’s launching without any fees. However, 180 days from now, Blur Governance ($BLUR holders, aka the DAO) will be able to vote and actively adjust the fees that Blend (the protocol) will charge from lenders and borrowers.

So, as we suspected, the 0 fee strategy that Blur pushed for a while is simply not sustainable (long-term) and they’re already looking for ways to put a sustainable business model in place.

That’s good news both for Blur, Blend and $BLUR holders. Not so much for users of the protocol. 😛

But they can still enjoy a 6 month period with 0 fees 💪

Wrapping Up

The next big phase of the internet starts with DOers who DO! 💪

And Blur’s certainly DOing. 😎

Sure, they’re still focusing solely on traders, but they’ve proven to be a worthy adversary to OpenSea in this marketplace war.

We all know… Competition = Innovation

And while the $BLUR airdrop appeared to be another fad, they quickly mobilized to show the web3 community that they’re not about that hype cycle. (I guess they follow Web3 Academy).

Following the latest developments in regards to OpenSea & Blur have been and will continue to be exciting and we’ll be sure to keep you update with anything that’ll come up.

That’s if for today frens, hope you have an amazing week and don’t forget to 👀🔛⛓️

What’s New In Web3?

NFT collection Goblintown will prioritize the ‘worst’ traders in second season mint

Proof is building a 3D world for its Moonbirds community

PayPal extending crypto transfers to more than 60 million Venmo customers

LimeWire launches web3 content subscription platform

🟣 Hold on, DOers!

Web3 excellence doesn’t come easy: it's time for homework! 💪🤓

START TO 👀🔛⛓️

We hope that today’s piece gave you a good overview of what Blend is, how it works and how Blur’s planning to use it to make money.

But if you want to see the Blend onchain activity LIVE, then head to our Dune Dashboard 👇

LISTEN

🎧 Join us in our recent DOer Spotlight episode where Jay and Kyle are joined by Lark Davis to discuss whether or not we’re in a crypto bull market right now. Tune in now! 🔥

Thanks for reading and we’ll see you tomorrow with the PRO Report! ❤️

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.